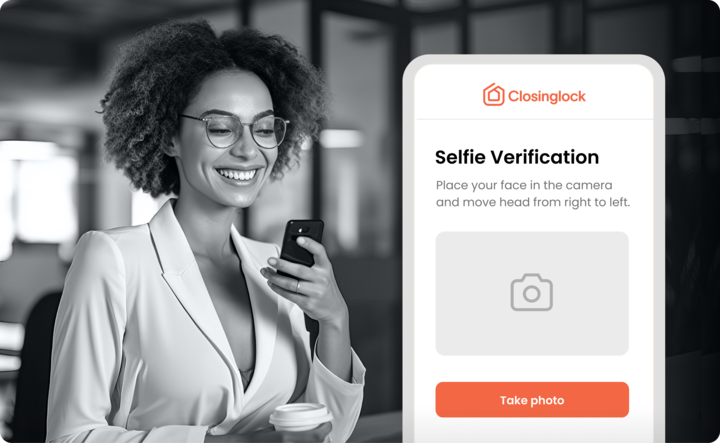

- Closinglock for Real Estate Payments

Move money securely—inbound and outbound.

Closinglock SecurePay gives homebuyers a simple, good-funds-compliant way to pay, while title and settlement teams have one secure platform to collect payments and automate verified disbursements—so every dollar moves safely and on time.