- Secure Wire Instructions

Keep wire instructions out of inboxes.

Emailed wire instructions expose buyers and sellers to major fraud risk. With Closinglock, title professionals can send and receive sensitive wire instructions inside an encrypted portal designed for both security and simplicity.

MILLION HOME CLOSINGS SECURED

0

BILLION PROTECTED

$

0

LOST TO FRAUD

$

0

WIRE FRAUD INSURANCE

$

0

M

How It Works

Trace, track, and verify every wire.

- Send and receive verified wire instructions through Closinglock’s encrypted portal.

- Download a Wire Certificate so your team has clear documentation for audits and internal reviews.

- Verify account details through Plaid, which connects to thousands of financial institutions for added assurance.

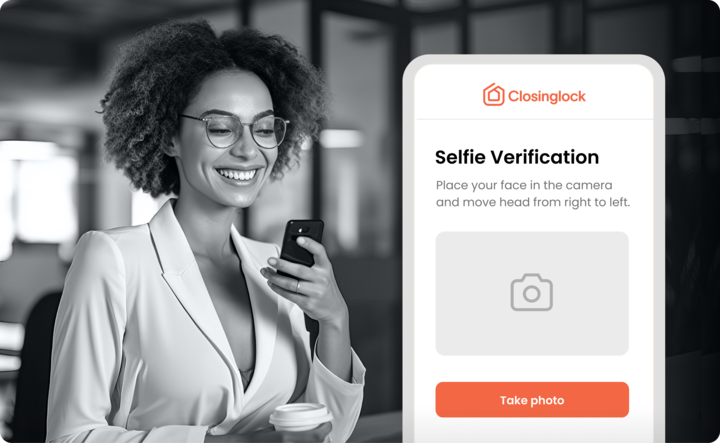

- Give clients secure access through multi-factor authentication without apps, downloads, or passwords.

- Closinglock includes insurance coverage up to $5M for wire instructions verified through Closinglock.

CONNECTS TO OVER 13K FINANCIAL INSTITUTIONS

Make wiring funds safe and easy for everyone.

CUSTOMER SUCCESS SPOTLIGHT

“It really provides security for ensuring that we are getting verified wiring instructions. It’s one of the things that gives me comfort in my day-to-day job.”

Kimberly Ziegler

Attorney , MGC Real Estate Law Group