- Closinglock for Fraud Prevention

Disappoint fraudsters.

Closinglock protects every real estate transaction from wire fraud with built-in verification, air-tight encryption, and $5M insurance per transfer.

Key Benefits

$500 billion in real estate transactions. $0 fraud.

Every year, thousands of homebuyers lose their life savings to real estate wire fraud—sometimes hundreds of thousands of dollars in a single mistake. Closinglock prevents that loss before it happens, protecting every dollar that moves through your transactions with secure verification and built-in fraud defense.

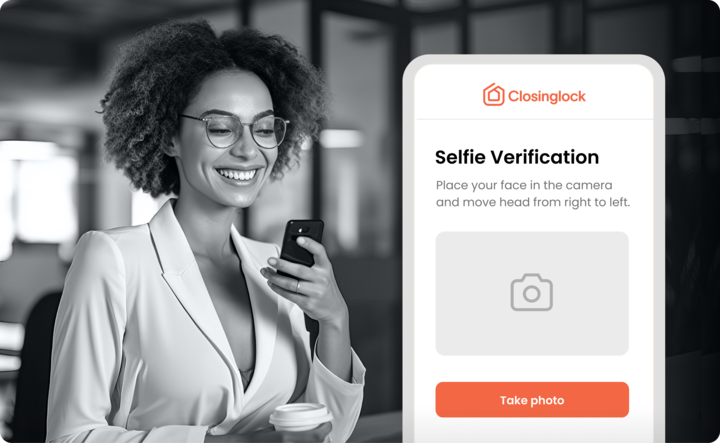

Know Who You're Working With

Go beyond basic pass/fail identity checks. Closinglock delivers KYC-based verification in a detailed report your team can review, act on, and keep for peace of mind.

Share Wire Instructions Safely

Closinglock eliminates the risks of email by giving title agents a dedicated, encrypted platform to share, verify, and confirm wire details with confidence.

Protect Every Payment

Closinglock secures every dollar in motion—from buyer deposits to outgoing disbursements—with $5M in coverage per transfer.

Verify Payoff Accounts in Real Time

With Closinglock’s payoff verification technology, title pros instantly find out if a payoff account is legitimate, or fraudulent.

UNDERWRITER SPOTLIGHT

“It’s almost rare to find a vacant land transaction that isn’t fraudulent now. That’s why it’s great to have a partner in Closinglock.”

Amanda Mitchem

Capital Title Insurance Agency