Instant and accurate identity verification

Fraudsters are impersonating sellers in an attempt to scam unsuspecting buyers out of funds. Vacant land, second homes, vacation and rental properties are among the most common targets.

But the jig is up! Closinglock’s identity verification software stops seller impersonation in its tracks, leveraging a multipronged strategy to detect and eliminate fraud.

Thorough

Verifies hundreds of data points across trusted, non-public data sources.

Versatile

Scans driver’s licenses, passports, foreign government IDs and more.

Seamless

Integrates into your existing workflow and usable at any time during closing.

Detailed

Delivers instant results with details on what passed, failed and needs review.

A meticulous approach to stop seller impersonation

1. Know-Your-Customer (KYC)

In today’s digital age, Knowledge-Based Authentication (KBA) has become outdated due to spoofing, AI, web and social media scraping. Closinglock leverages KYC, which checks against trusted, non-public data sources.

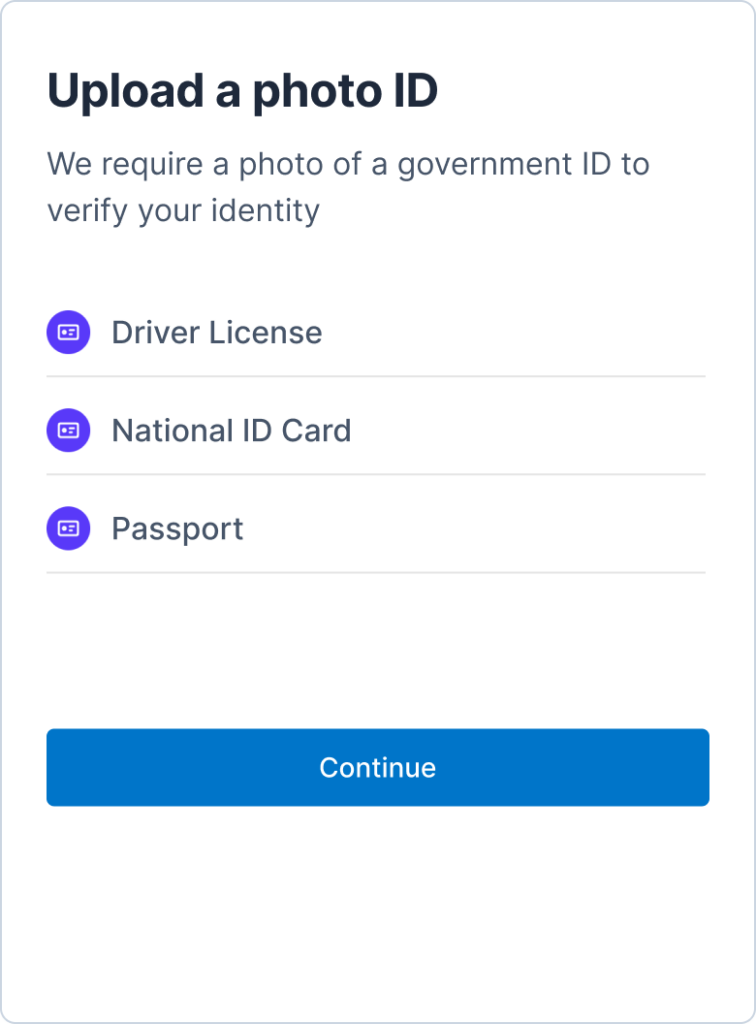

2. Government ID analysis

Validate both US and foreign government IDs including driver’s licenses and passports. End users can easily scan the front and back of the ID which is then verified through the relevant authoritative database.

3. Additional lookups

With additional inputs including email, phone, date-of-birth, documents and more, Closinglock analyzes hundreds of datapoints so buyers, sellers and settlement companies can move forward with confidence.

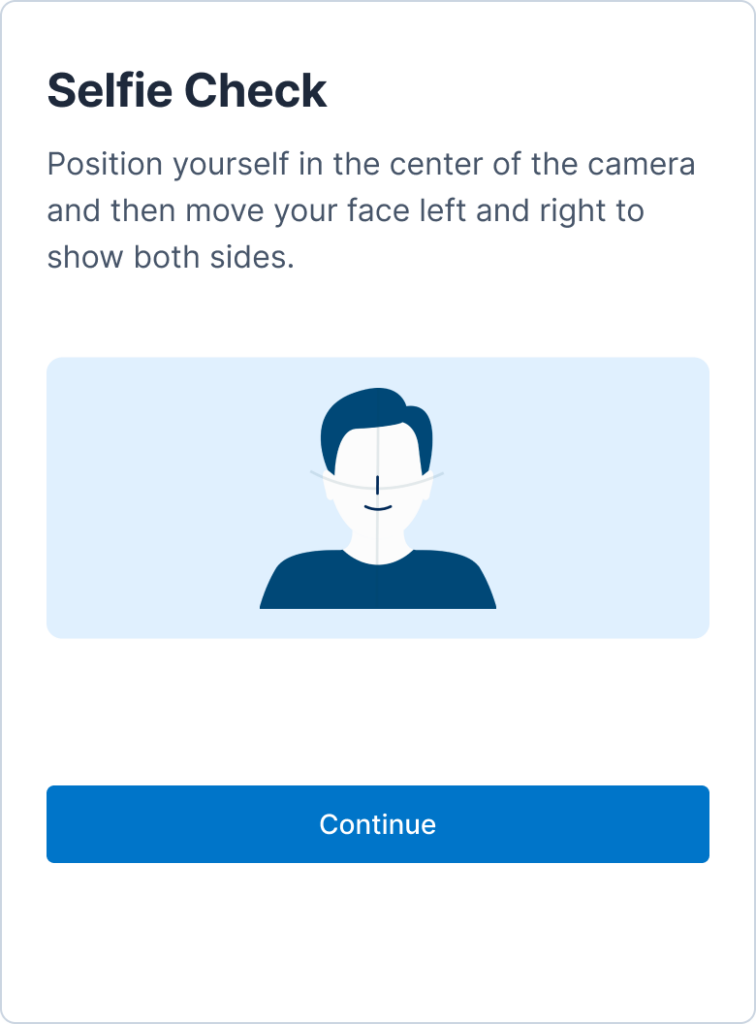

4. Selfie Check

For verifications requiring extra assurance, Selfie Check is triggered using advanced facial recognition technology to precisely match the individual’s photograph with their government ID.

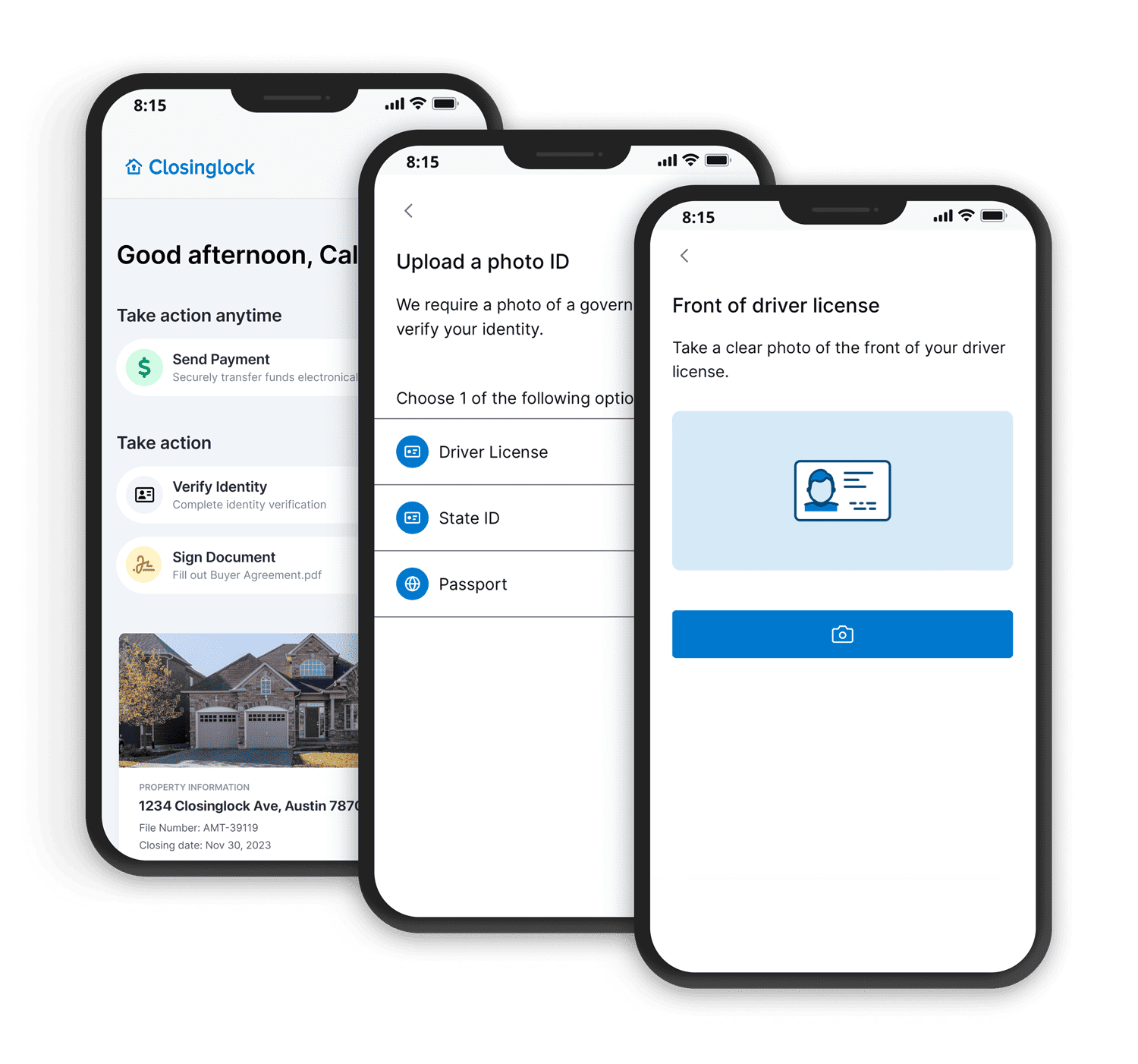

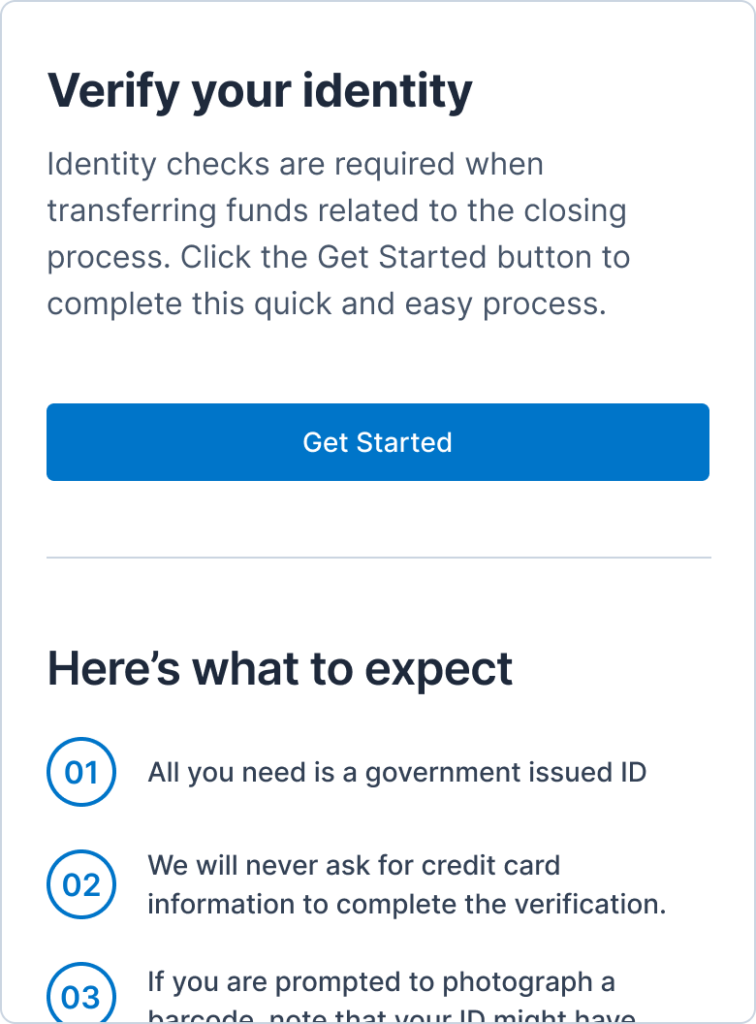

A seamless experience for buyers and sellers

Identity verification can be requested at any point during the closing process, for both buyer and seller. With just a few quick and easy steps to complete, the verification process is done in a matter of minutes.

1.

Expectations are outlined prior to getting started

2.

The type of government ID being verified is submitted

3.

Additional inputs are collected for further identity verification

4.

If needed, a selfie check is prompted and submitted

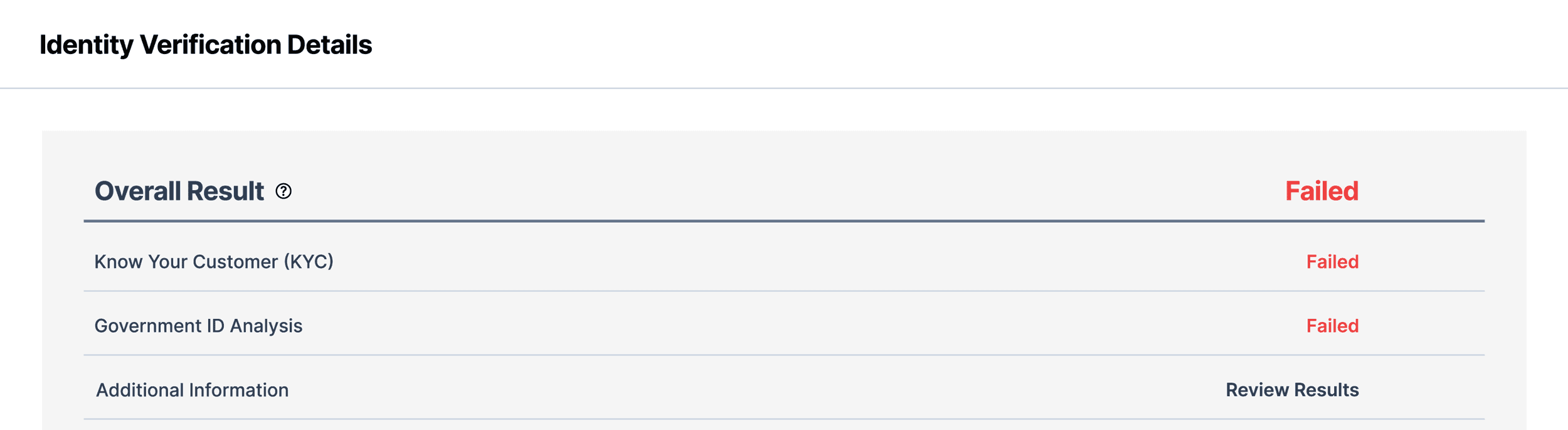

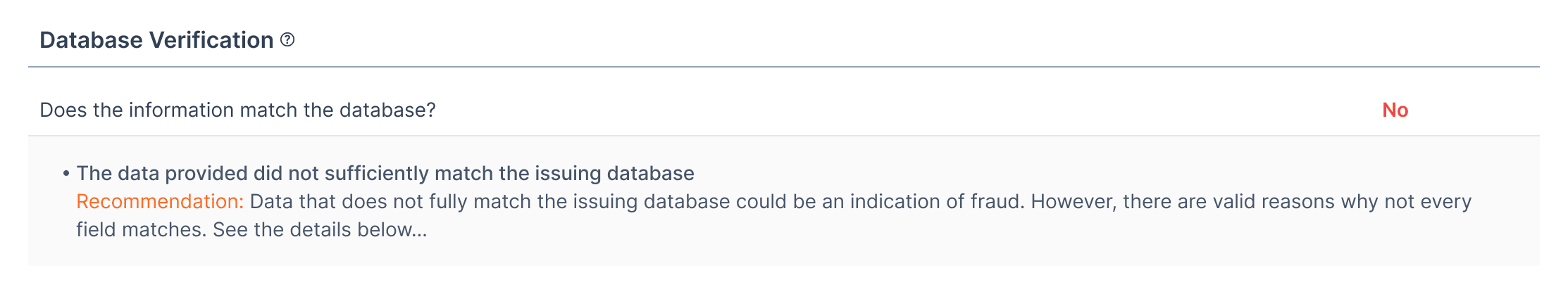

Results and recommendations delivered instantly

Closinglock’s identity verification gets to work fast, immediately providing a detailed report (to the requesting agent) upon submission. This will include what checks passed, failed and need further review.

For specific checkpoints that did not pass, our report will provide a reason for the red flag and recommendations on how to best determine if fraud is involved.

“We needed something to verify our clients’ identities, especially on vacant land transactions. It’s almost become rare for us to find a vacant land transaction that’s not fraudulent now. That’s why it’s great to have a partner in Closinglock.”

Amanda Mitchem

CAPITAL TITLE INSURANCE AGENCY

Internal Operations Manager

Frequently Asked Questions About Identity Verification

How will I receive the ID verification results?

The results from the identity verification are ready right away after cross-checking the information with many data points. When complete, an email relays the status—Passed or Needs Review. To gain further details of the results, simply log in to the Closinglock Portal.

Can KBA be used as a backup for fraud prevention?

In the past, KBA worked great for verifying identities and other personal information. Now, however, it has too many breaches allowing fraudsters to pull off their scams. KBA lacks security, has a high drop-off rate, and uses publicly accessible information through web and social scrubbing. It will not give you the security you need to provide safe real estate transactions.

Can Closinglock’s ID Verification identify a fake ID in the identity verification process?

Yes! Our system very carefully assesses the front and back of the ID, image and barcode, as well as uses optical character recognition to identify patterns as it pertains to other data points. We are able to determine whether it is a legitimate ID.

The future of closing is here—and it's secure.

Whether you’re a title company, a law firm, or an agent, Closinglock helps you protect what matters most.

© 2025 Closinglock, Inc.

100 Congress Avenue, Suite 300, Austin, TX 78701