- Closinglock for Attorneys

One secure platform for every closing.

Strengthen your trust account processes and protect every client with verified payments, identity checks, and fraud-resistant workflows—all in one connected system.

Protect client funds. Prevent impersonation. Work with confidence.

Create smoother, more secure closings for your team and your clients.

Disappoint Fraudsters

Keep trust account funds safe with encrypted wire instructions, real-time account verification, and up to $5M in insurance per digital payment. Built-in safeguards help stop phishing, spoofing, payoff fraud, and seller impersonation before they reach your practice.

Equip Your Team

Wire instructions, identity checks, payoffs, disbursements, and eSigning—all in one place. Reduce manual steps, eliminate re-keying, and save hours on every closing with structured workflows that support your fiduciary responsibilities.

Delight Your Clients

Give buyers a fast, insured way to send funds in minutes—no bank visits or confusing wire transfers. SecurePay has protected more than $3B in digital closing payments with zero losses, creating a smooth, professional experience your clients can trust.

CUSTOMER SUCCESS SPOTLIGHT

“Closinglock has made us more efficient. It has saved us time. But more importantly, we feel safer.”

Angela Stewart DeLorme

P.C., Attorneys at Law

KEY FEATURES

Essential features to secure & streamline your workflow.

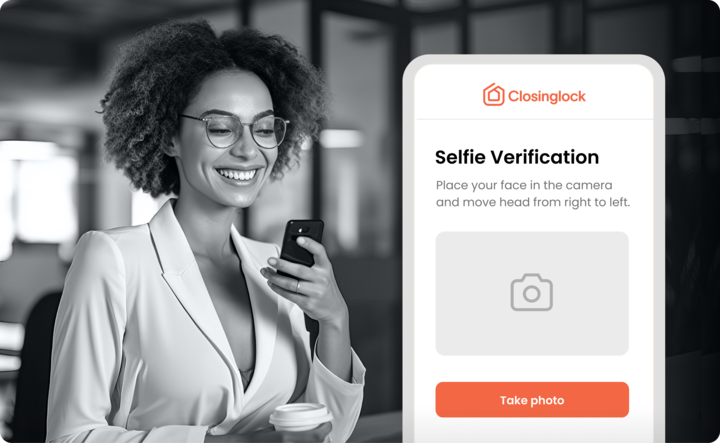

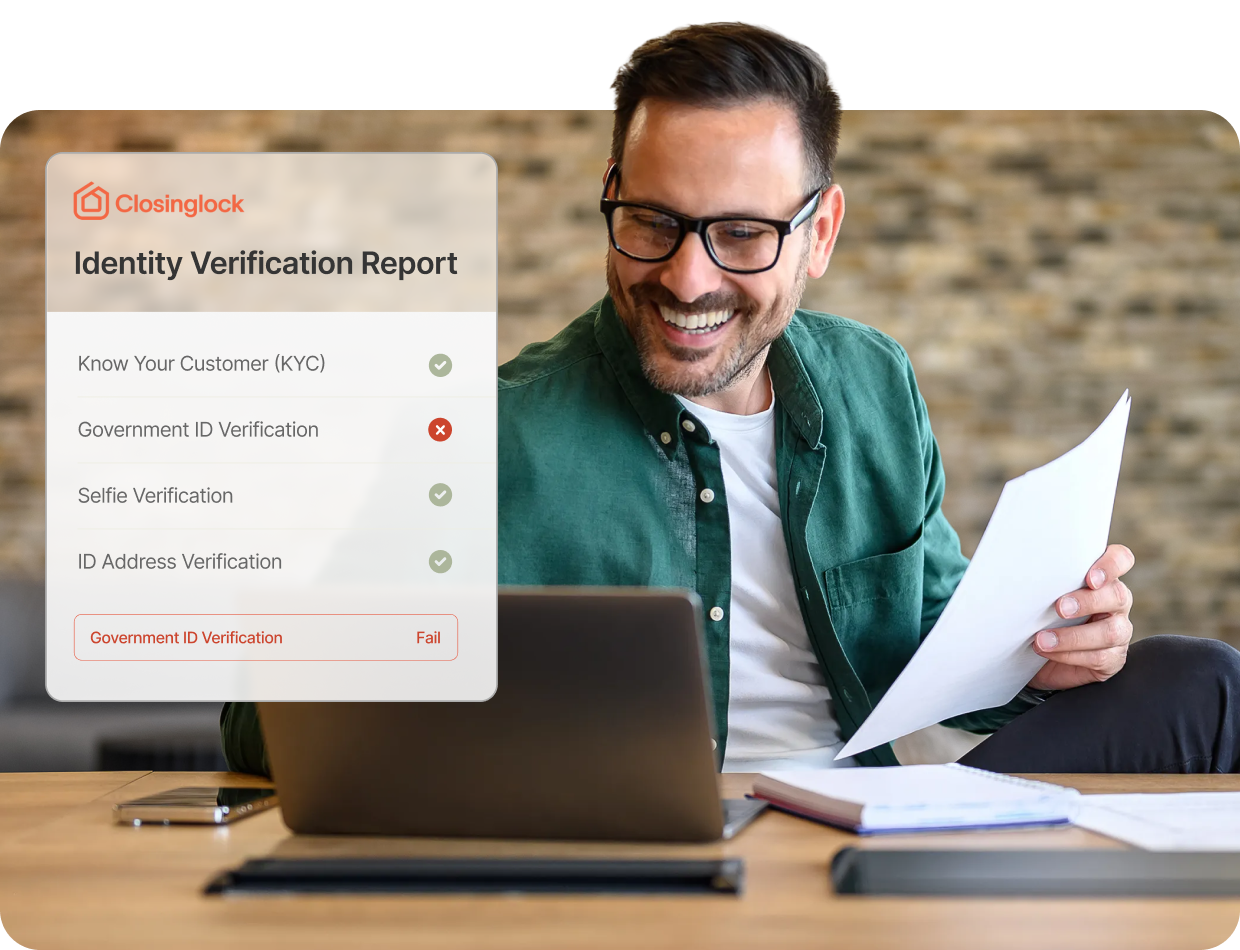

Identity Verification

Instantly stop impersonation scams before funds move.

- Confirm buyer and seller identities across trusted, non-public databases.

- Detect real-estate–specific fraud signals earlier in the process.

- Use optional selfie verification for high-risk scenarios.

- Review a detailed, multi-page identity report with 50+ data checks.

- Support trust-account requirements with defensible, documented verification.

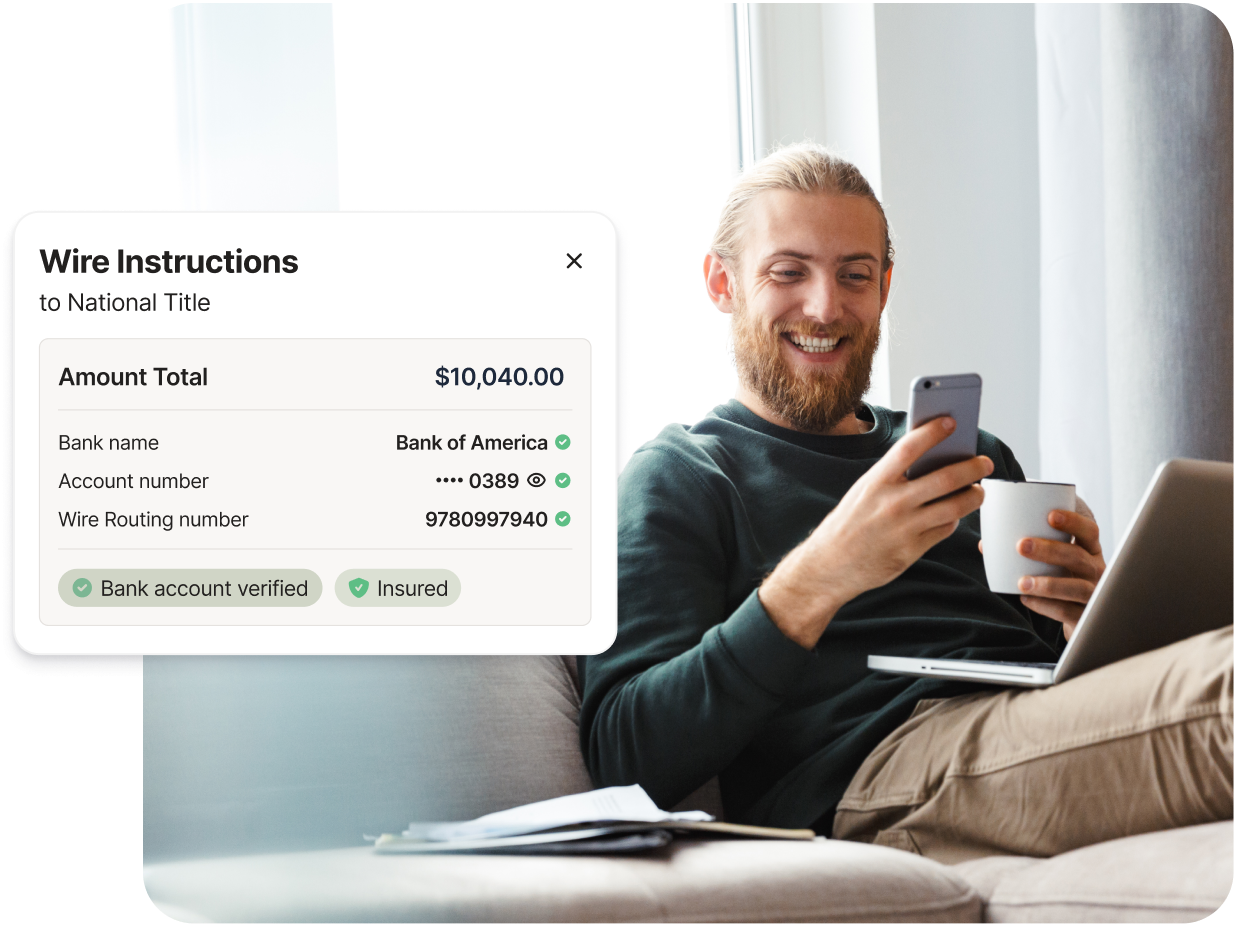

Wire Instructions

Protect every payment with verified, authenticated instructions.

- Deliver wiring details through an encrypted, private portal—never email.

- Lock down transfers with bank-level authentication.

- Give clients clear, safe instructions without confusion or risk.

- Reduce malpractice exposure tied to misdirected wires.

SecurePay

Give buyers a safer, easier way to pay.

- Buyers send earnest money and closing funds in minutes from any device.

- Keep payments good-funds compliant and insured up to $5M.

- Reduce manual trust-account checks with automatic file matching and real-time alerts.

- Strengthen oversight with defensible, verified payment documentation.

Verify Payoffs

Retrieve and verify payoff details in minutes—not hours.

- Order payoff statements without long calls or lender portals.

- Verify account legitimacy using trusted financial data sources.

- Catch mismatched or fraudulent details early, before trust-account funds move.

- Document each verification step to reduce liability and support compliance.