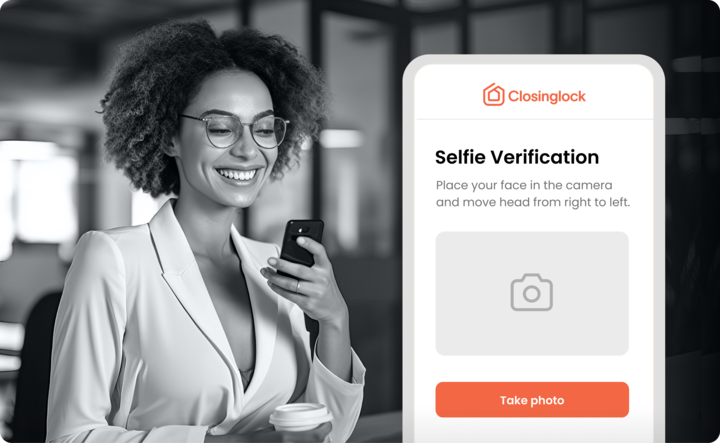

- Automated Payoff Retrieval

Chase growth, not payoffs.

You didn’t get into this business to chase payoffs or re-key data. Cut the time you're spending collecting borrower data, manually requesting, and verifying down to seconds. Request a payoff with a few details—no emails, faxes, or calls—and once it’s returned, Closinglock verifies it instantly and insures every verified payoff up to $5M.

How It Works

Save up to 125 hours

each month.

- Order payoff statements in seconds.

- Track status of payoff retrieval and verification in real-time.

- Retrieve statements without calls, emails, or portals that slow your team down.

- Protect funds with up to $5M insurance per verified payoff.