- FinCEN Compliance

The easiest way to meet FinCEN compliance.

Closinglock lets you collect required FinCEN data with a single, Docusign-powered form that cuts down hours of back-and-forth.

SIGNATURES COMPLETED IN 24 HOURS

0

%

REDUCTION IN AVG. CONTRACT TURN TIME

0

%

CUSTOMER SUPPORT SATISFACTION RATING

0

%

CENTRALIZED HUB FOR CLOSING COMMUNICATION

1

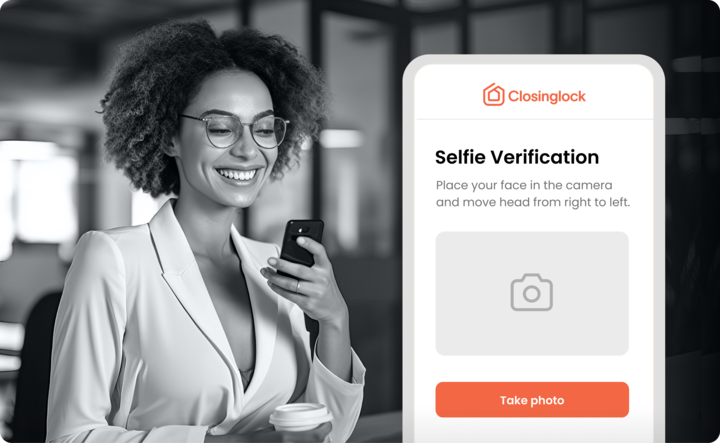

How It Works

Lighten the load of new FinCEN requirements.

- Send a user-friendly FinCEN form to clients in just a few clicks.

- Certify signatures with Docusign’s tamper-proof seals and completion certificates.

- Sync completed forms to client files inside Closinglock, where they remain protected.

- Access a full audit trail at any time, including IP addresses, IDs, and timestamps—so you always know who signed, when, and how.