- Identity Verification

The first step in protecting funds.

ALTA Best Practices require identity verification before funds move. Closinglock gives you the most complete, actionable verification in real estate providing a detailed, multi-page report you can act on.

IDENTITY VERIFICATION

PASS RATE

PASS RATE

0

%

ID VERIFICATION

REPORT IN THE MARKET

REPORT IN THE MARKET

#

1

LOST TO

FRAUD

FRAUD

$

0

DATA POINTS

VERIFIED

VERIFIED

0

+

How It Works

Stop impersonation. Protect your clients.

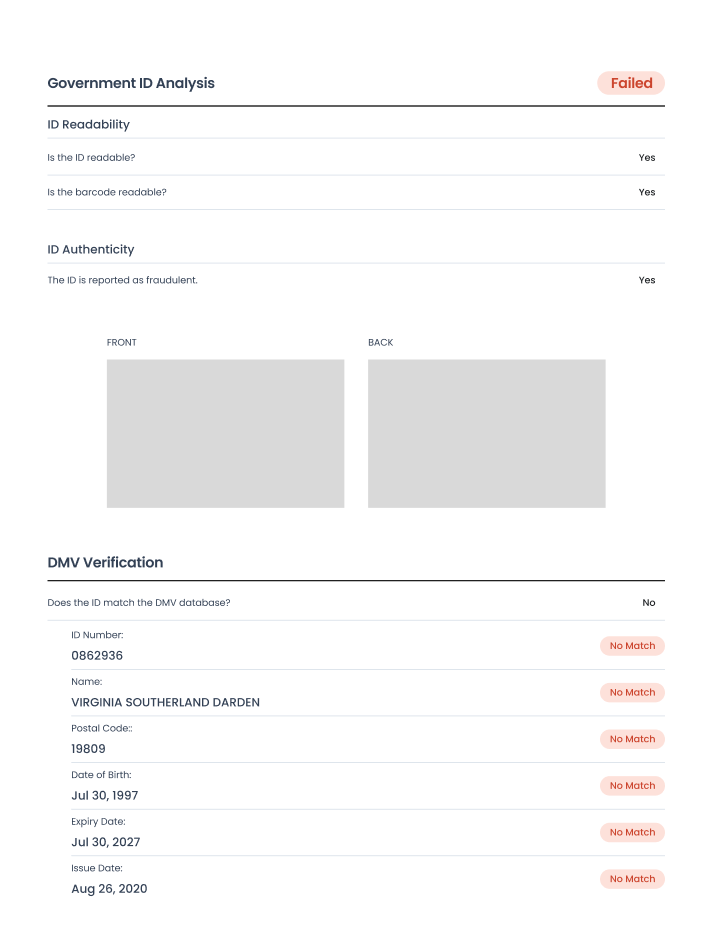

- ID Confirmation across U.S. and international databases.

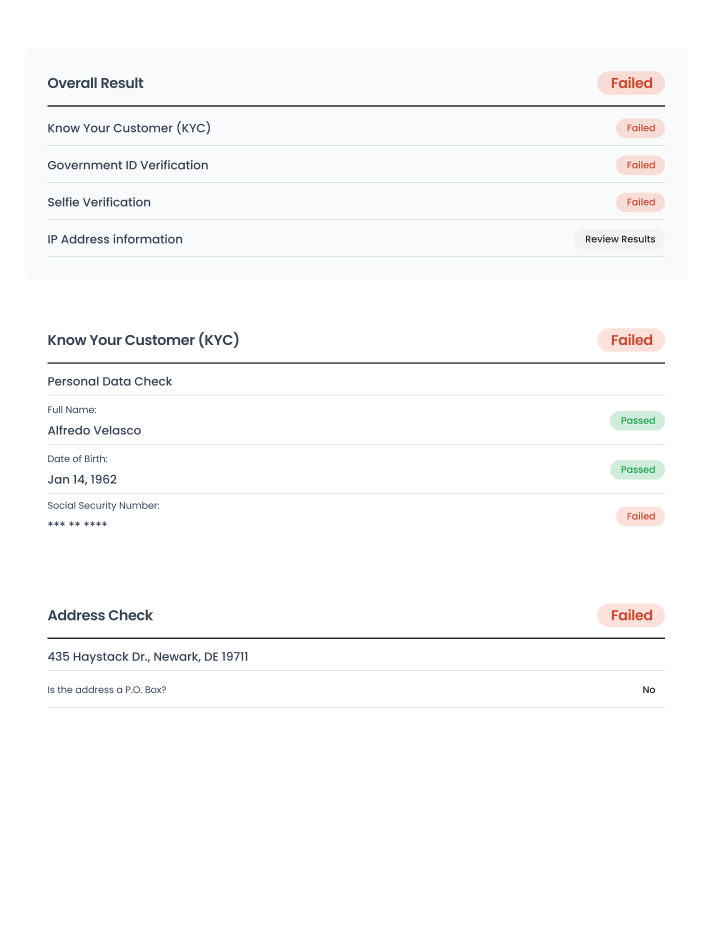

- Know-Your-Customer (KYC) checks against hundreds of non-public data sources.

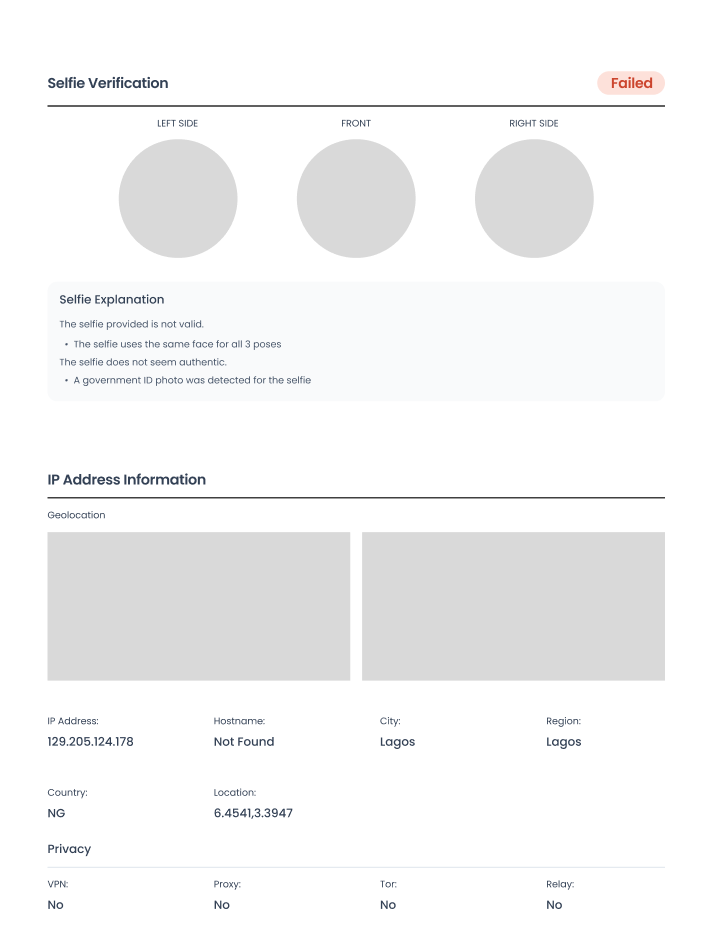

- Selfie Verification uses advanced facial recognition when the risk is high.

- User-Friendly Interface makes it simple to run ID verification in person as needed.

- A detailed, multi-page identity report gives you clearer insight than a simple pass/fail.

The #1 ID Verification Platform

Meet the most powerful ID verification report in real estate.

CUSTOMER SUCCESS SPOTLIGHT

“It’s almost rare to find a vacant land transaction that isn’t fraudulent now. That’s why it’s great to have a partner in Closinglock.”

Amanda Mitchem

Capital Title Insurance Agency