- Verify Payoffs

Verify every payoff before you release a dollar.

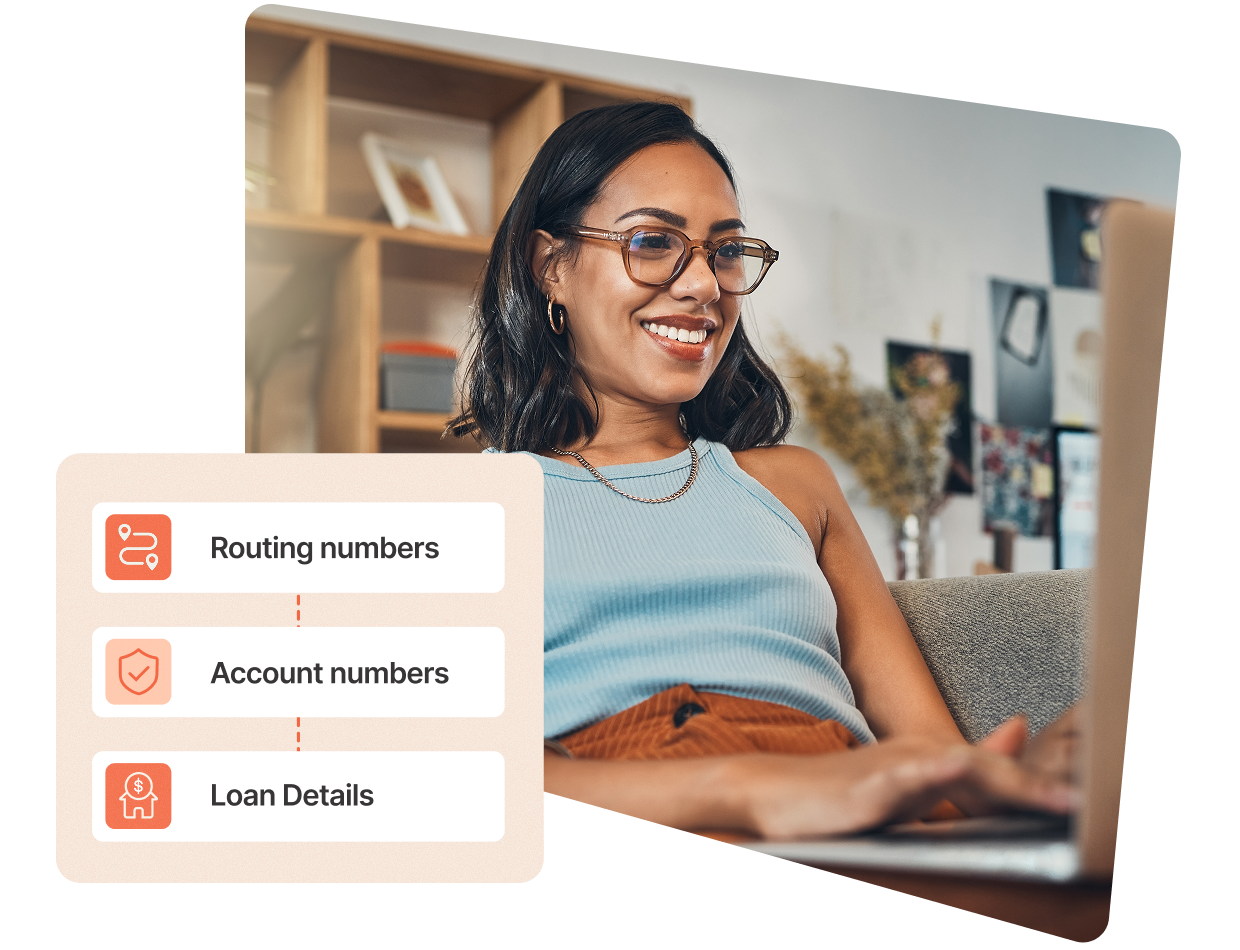

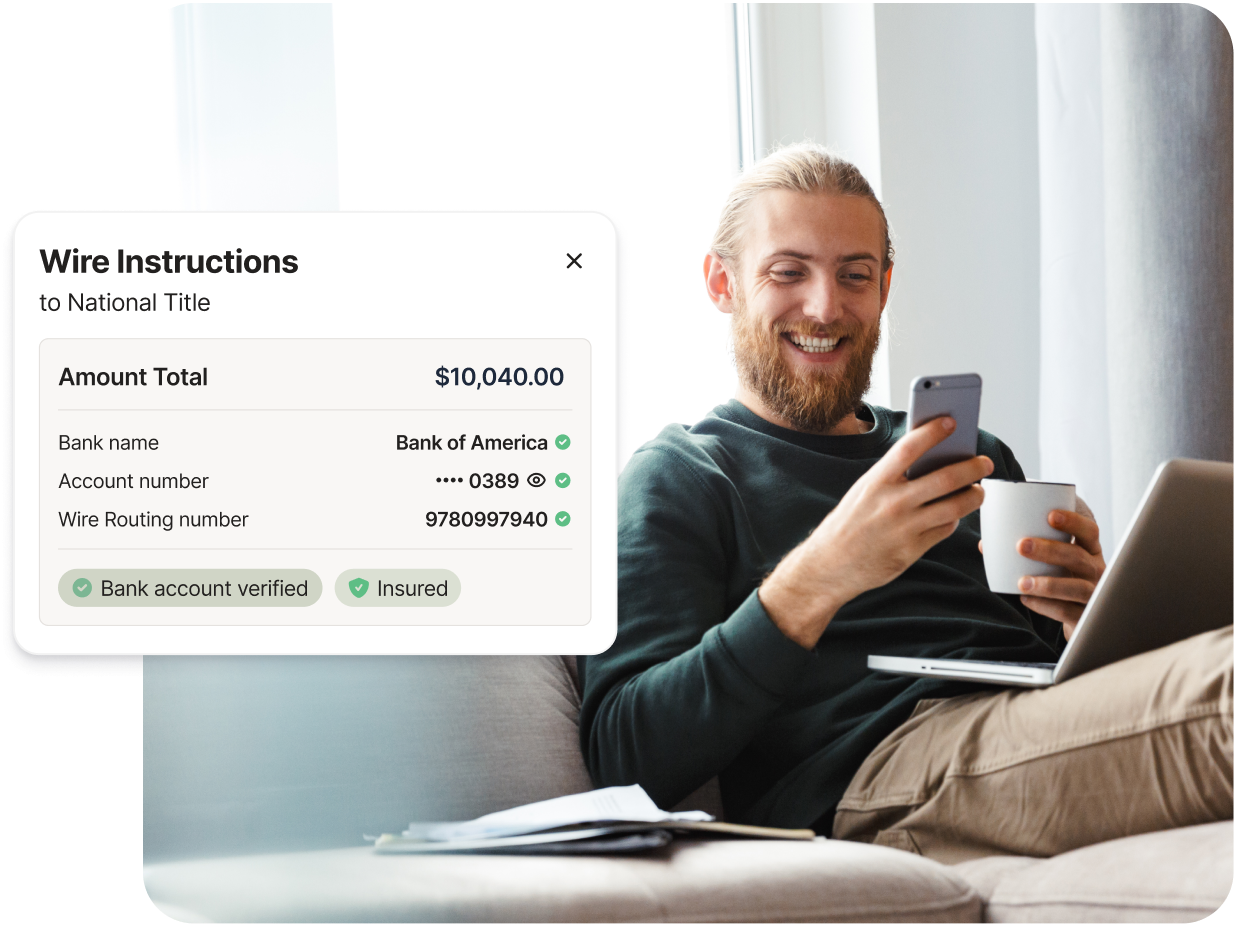

Payoff fraud is one of the biggest risks in closing. Closinglock’s payoff verification tool confirms that routing numbers, account numbers, and loan details belong to the right financial institution before funds move. It’s a fast, secure way to protect your team, your clients, and every transaction.

HOME CLOSINGS SECURED

1.5

M

PROTECTED

$

0

B

LOST TO FRAUD

0

INSURANCE ON EVERY VERIFIED PAYOFF

$

0

M

HOW IT WORKS

Verify payoff information in seconds.

- Enter routing numbers, account numbers, and loan details directly into Closinglock.

- Instantly check those details against trusted financial data and thousands of legitimate institutions.

- Identify mismatches or fraudulent information before money moves.

- Add an extra layer of protection with $5M in insurance on every verified payoff.

UNDERWRITER SPOTLIGHT

"We love the payoff verification tool. We use that on a daily basis as payoffs are coming in to verify their authenticity. It's my most favorite part of Closinglock."

Lauren Beyersdorf

Director of Client Services & Closing Agent Black Hills Title