- Closinglock for Underwriters

Reduce fraud exposure. Strengthen your network.

Underwriters carry the financial and reputational risk of every closing. Closinglock gives your agents a secure, modern system for moving money—reducing claims, improving consistency, and strengthening confidence across your entire network.

Why underwriters recommend Closinglock.

Title companies can protect their clients from rising real estate fraud with modern, KYC-based identity checks from non-public databases.

Reduce risk where it matters most

Money movement is the riskiest part of any closing. Closinglock protects every transfer with verified instructions, encrypted delivery, identity checks, and full audit trails—dramatically lowering exposure across your network.

Protect your network from seller impersonation and vacant land fraud

Closinglock’s identity verification uses real-estate–specific fraud signals, non-public data sources, and optional selfie matching to confirm identity before funds move. This helps underwriters stop impersonation attempts early and prevent claims that can impact loss ratios.

Raise the standard across every agent office

Recommending Closinglock ensures every agent follows consistent, ALTA-aligned practices for payments, identity checks, payoffs, and documentation—reducing variance and protecting your brand.

UNDERWRITER SPOTLIGHT

"Title agents who work with Closinglock love Closinglock...the workflow is amazing and it makes their job so much easier. And that's exactly what we need is to have that transaction from order entry to closing to be easier, smoother, and safe."

Cindy Immonen

NTP, CLTP, Account Manager, FNF Michigan Agency

KEY FEATURES

How Closinglock strengthens security and protects your network.

Identity Verification

Confirm identity before funds move and stop impersonation fraud early.

- Validates identity against non-public, authoritative data sources.

- Identifies real-estate–specific fraud signals that generic ID tools miss.

- Uses optional selfie verification for high-risk scenarios, including vacant land.

- Provides a detailed, multi-page report instead of a simple pass/fail.

- Helps agents follow ALTA Best Practices for identity confirmation without slowing the closing.

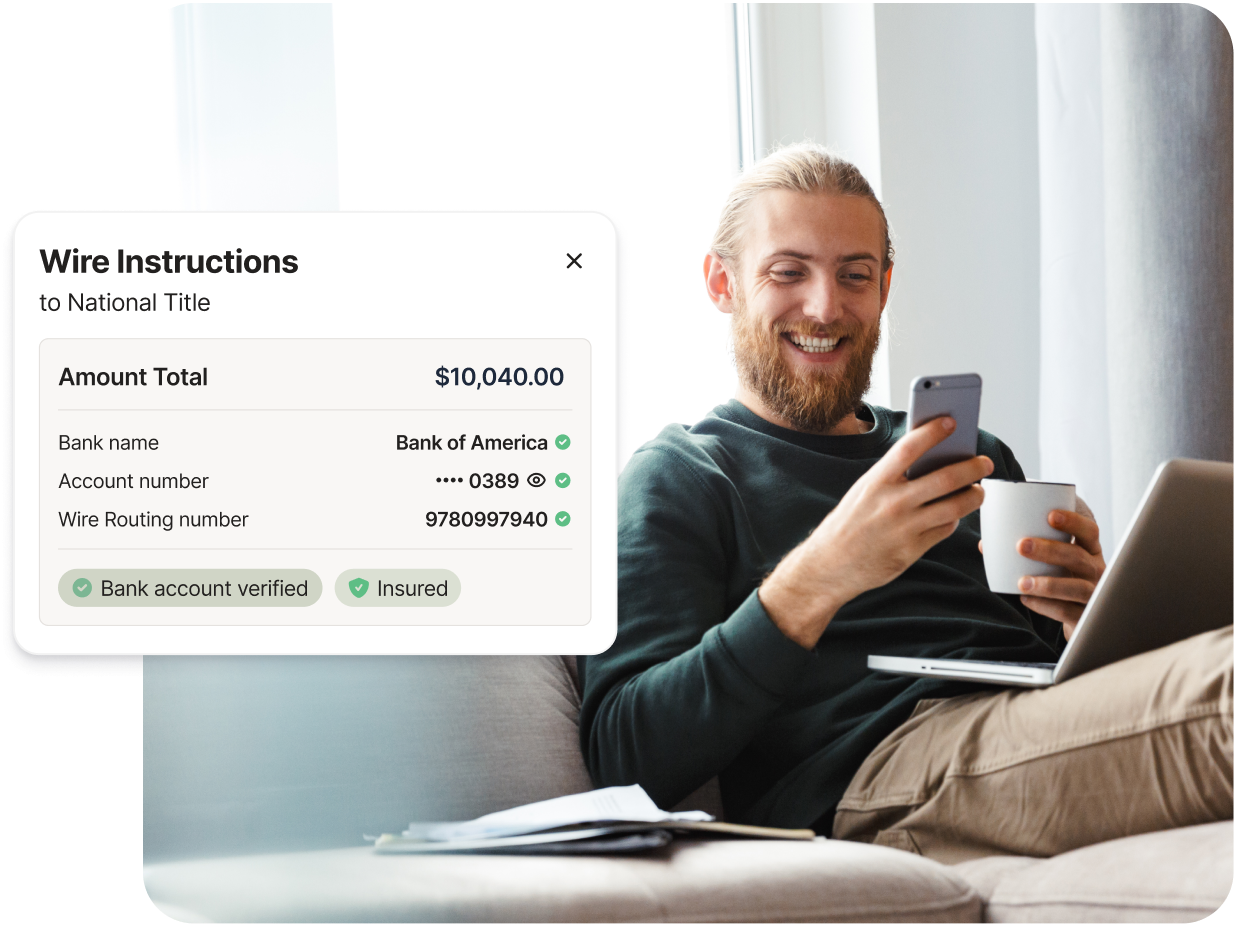

SecurePay

Protect inbound funds with verified, insured digital payments.

- Verifies buyer accounts before funds move.

- Eliminates the risk of emailed wire instructions.

- Insures every digital payment up to $5M per transaction.

- Creates a permanent audit trail from payment initiation to deposit.

Disbursements & Payoff Automation

Automate the highest-risk workflows with verified disbursements.

- Retrieves payoff statements directly and verifies account ownership.

- Flags mismatches or suspicious activity before funds move.

- Replaces manual steps that lead to preventable claims.

- Ensures every outbound dollar is verified, tracked, and auditable.

Verify Payoffs Statements

Stop payoff fraud before it becomes an underwriter claim.

- Validates payoff instructions against authoritative lender sources.

- Detects altered or spoofed statements in real time.

- Creates tamper-evident documentation for underwriting review.

- Reduces exposure to a rapidly growing fraud vector.