Built-In Fraud Protection

Wire instructions and payments stay secure within Closinglock — no risky emails, mistyped numbers, or interception.

Direct Insurance Coverage

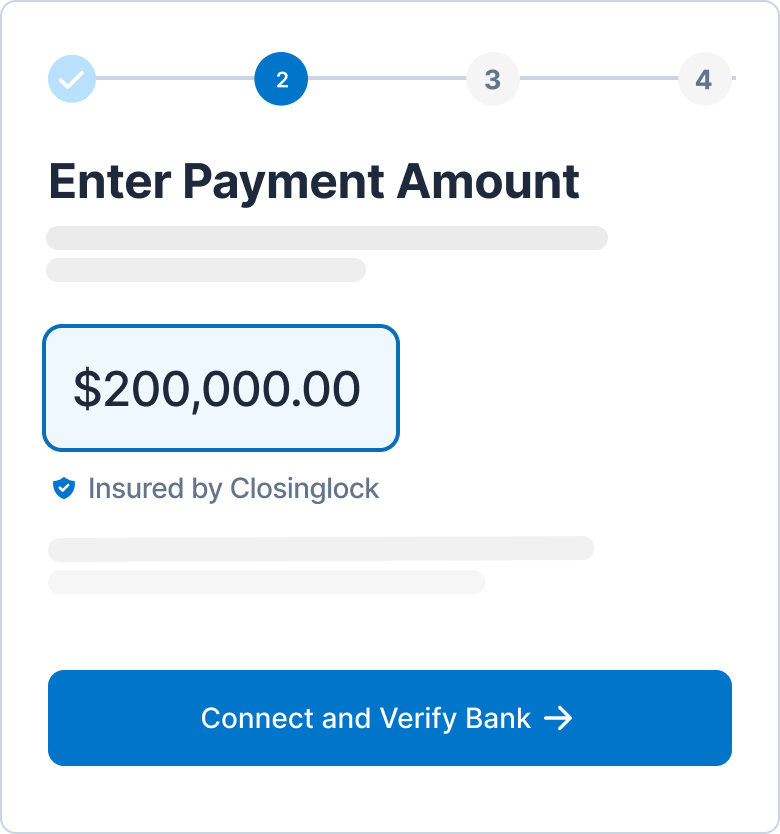

Every payment through Closinglock is automatically insured up to $2.5M per transaction, at no extra cost.

On-Time, Every Time

Meet timelines with confidence. Same-day delivery keeps funds (and closings) moving forward without last-minute delays.

Reclaim Your Time

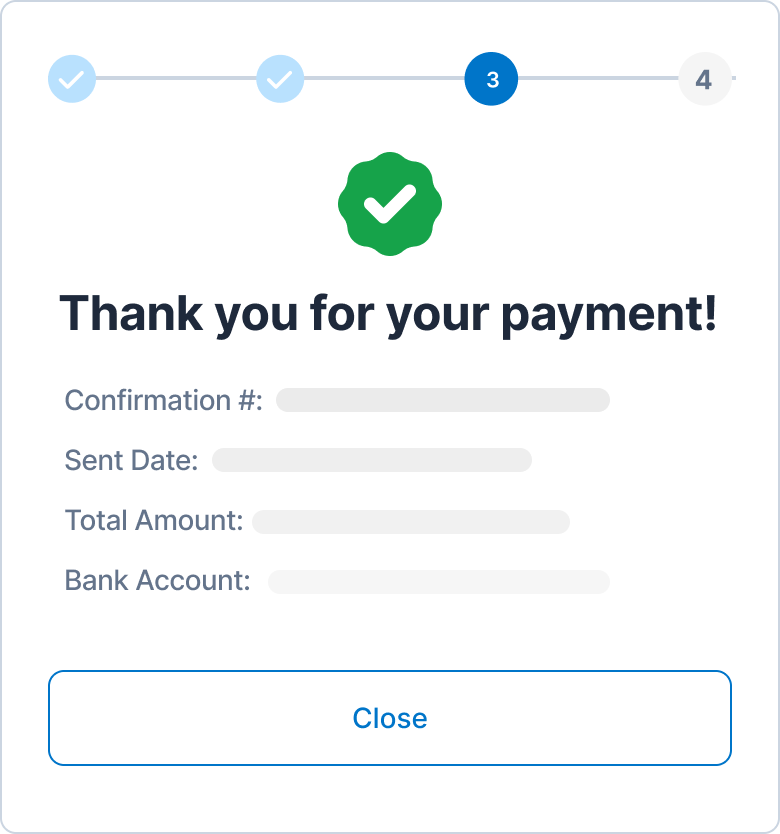

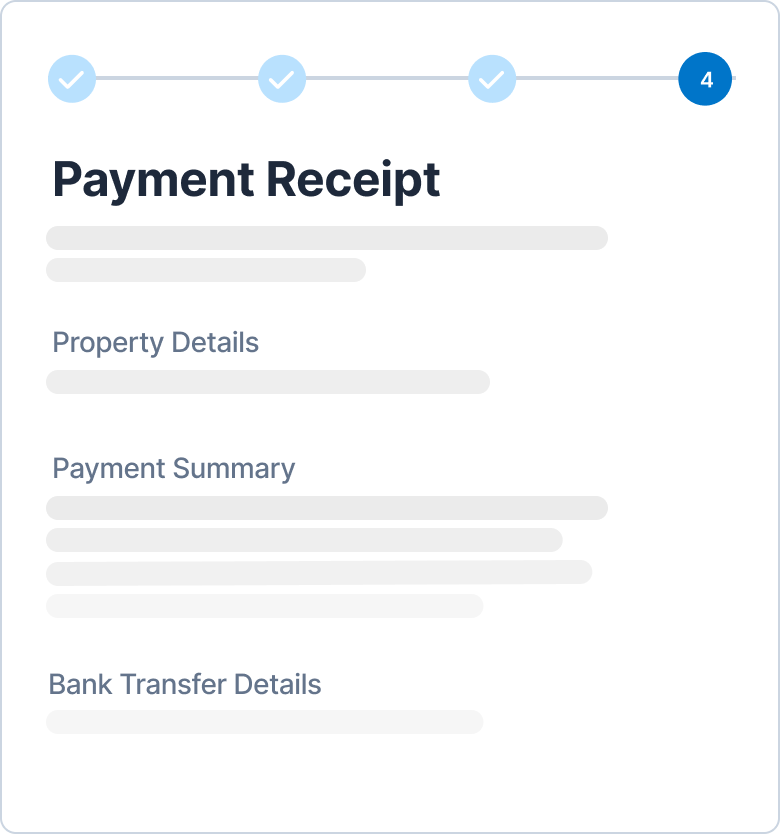

Enjoy real-time updates, file matching, and fewer buyer calls — so you can focus on closing, not chasing payments.

Give buyers a secure, insured way to pay — while simplifying your workflow.

Better closings start with better payments.

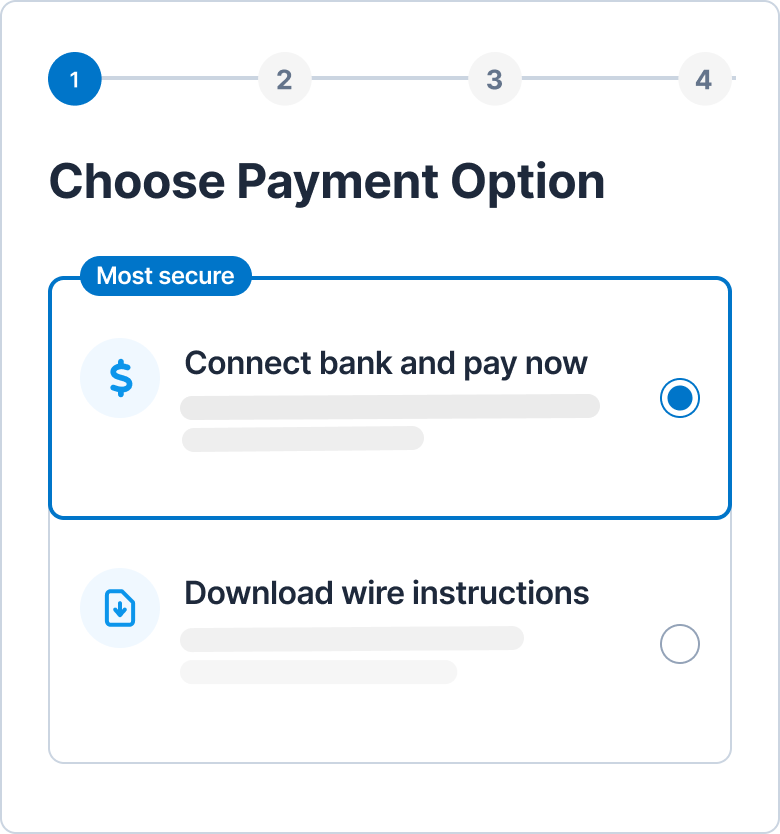

Initiate a secure payment request from Closinglock.

Buyer logs in and follows the simple, guided flow to send payment.

Good-funds compliant payment, insured up to $2.5M.

Capital Title of Texas

SecurePay supports Real-Time Payments (RTP).

Closinglock SecurePay supports Real-Time Payments (RTP) for buyers whose banks offer it. These transfers are instant and can be completed after hours and on weekends—a helpful option for time-sensitive closings.

Not all banks support RTP yet.

Want to check if yours does? Explore these resources:

Modern Treasury: What is RTP?

The Clearing House

Federal Reserve Bank Services

Nearly $2B

in funds securely transferred

50%+🙋🏽

4.7 / 5

Frequently Asked Questions (FAQ)

Why should our buyers use the Closinglock SecurePay to make a payment instead of working directly with their bank?

Buyers give SecurePay a 4.7 out of 5 star rating for the convenience, security and speed.

Title teams appreciate that they can offer their clients payment options, including the secure digital payment solution that supports same-day good funds compliant payments to keep closings on track.

Sounds great for the buyers, but what’s in it for us at the Title Company?

More importantly, SecurePay is the most secure way for your buyers to send earnest money, cash to close and other closing costs. SecurePay securely matches your verified wire instructions with the buyer’s verified bank account resulting in a good funds compliant funds transfer that leaves zero room for error or fraudsters. And, each payment is insured at no extra cost to you, giving you and your clients added peace of mind.

- Good Funds compliant in all 50 states.

- Realtime payment tracking notifications and receipts so you and your buyer can follow funds as they’re transferred.

- SecurePay payments auto-match to your Closinglock files so you don’t have to keep checking the ledger

- Closinglock saves your clients valuable time with no apps to download, registration, or passwords to remember or recover.

Our company receives a lot of calls from buyers who want to know if we have received their payment. How does sending the payment through Closinglock help?

How much time is this going to take my staff to learn and do we have to completely change our process for collecting payments?

Is there any setup required with my escrow account to enable payments to be deposited into this account?

No additional setup is required on your end to use Closinglock SecurePay.

If you want to enable RTP so you can receive wires instantly, you may need to work with your bank to enable RTP. Our team is happy to help guide you through the process.

The future of closing is here—and it's secure.

Closinglock helps title companies, law firms, and underwriters protect what matters most—their clients, their transactions, and their reputation.

© 2025 Closinglock, Inc.

100 Congress Avenue, Suite 300, Austin, TX 78701