Good Funds payments made easy

Introducing the Good Funds tool that is revolutionizing payments in real estate. Settlement companies can now securely receive earnest money deposits and cash-to-close payments directly through Closinglock, as Good Funds.

Secure

Transactions are protected by 256-bit AES encryption and SOC 2, Type 2 compliance.

Fast

Funds can be wired or sent as a Real Time Payment (RTP) for a speedy and timely delivery.

Convenient

Know when payments are sent and received without having to check your account.

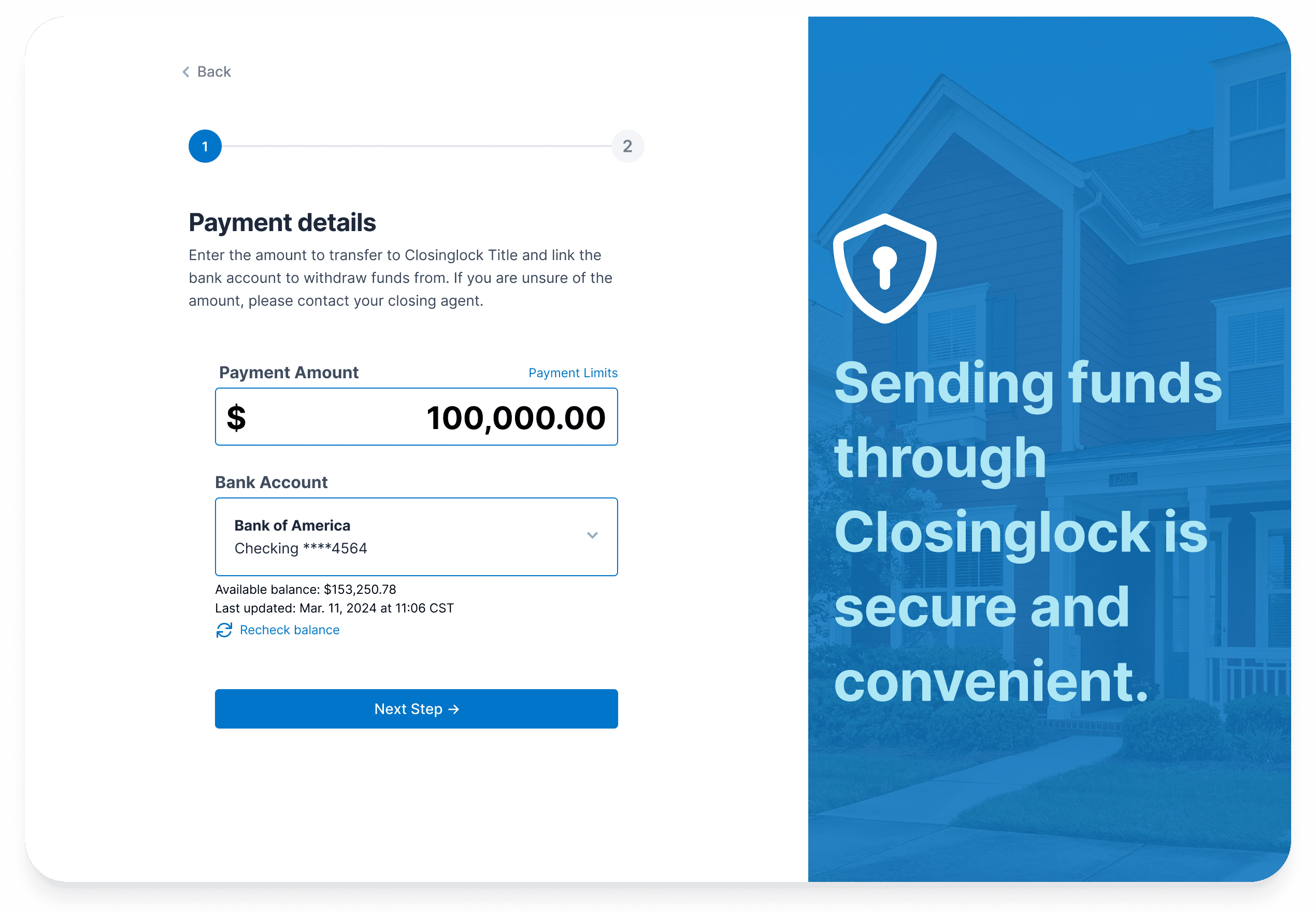

Streamlining the transfer of funds

With your escrow account safely stored and designated in Closinglock, your clients can forget about wire instructions.

Eliminate costly and time-consuming delays due to account/routing number errors, incorrect transfer methods or bounced checks.

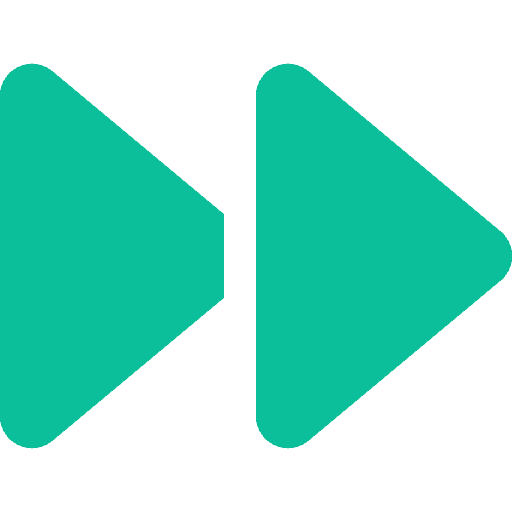

Receive detailed payment receipts that include file number and property, eliminating the headache of matching deposits to files.

Bringing real estate payments into the modern age

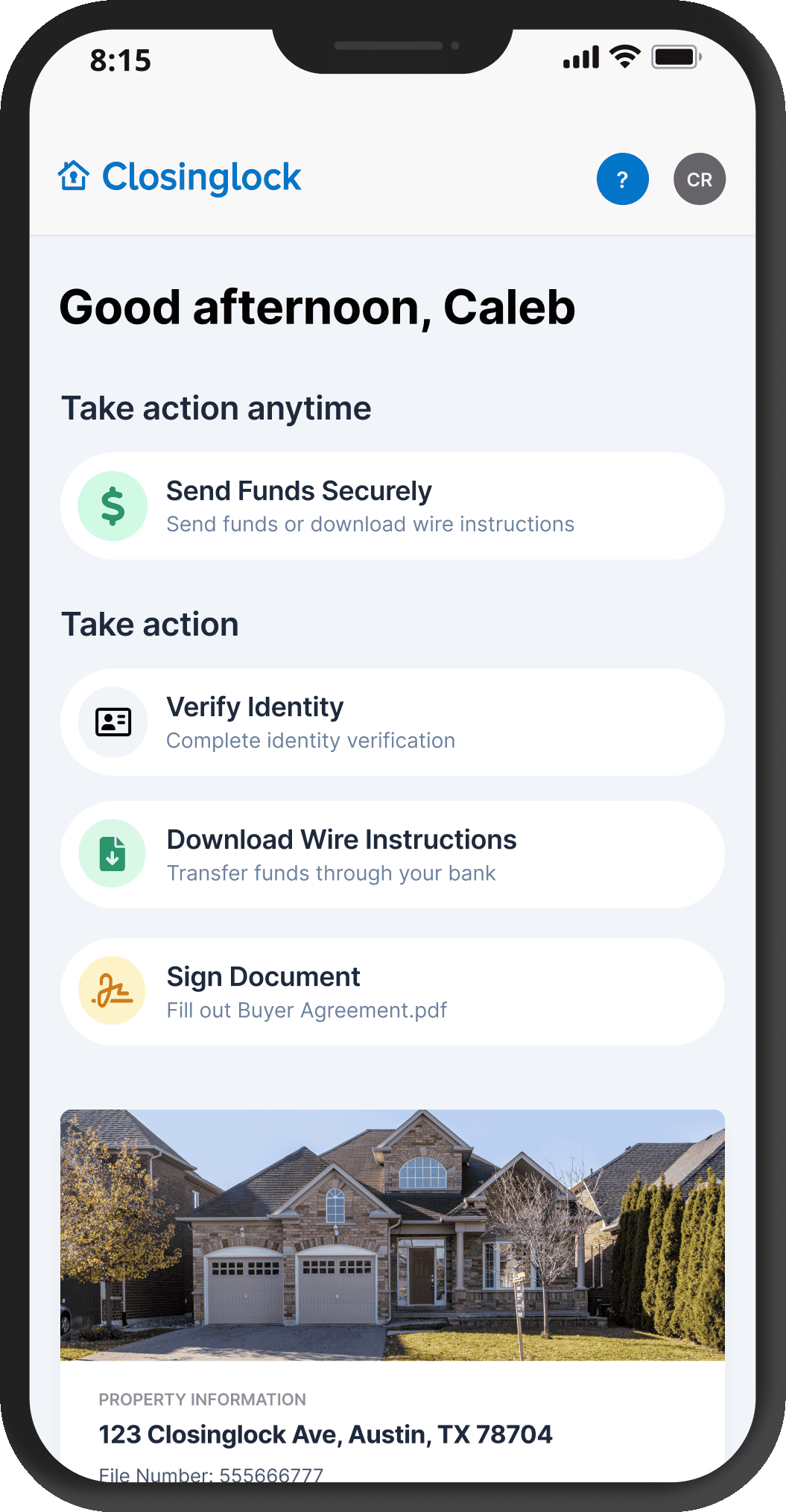

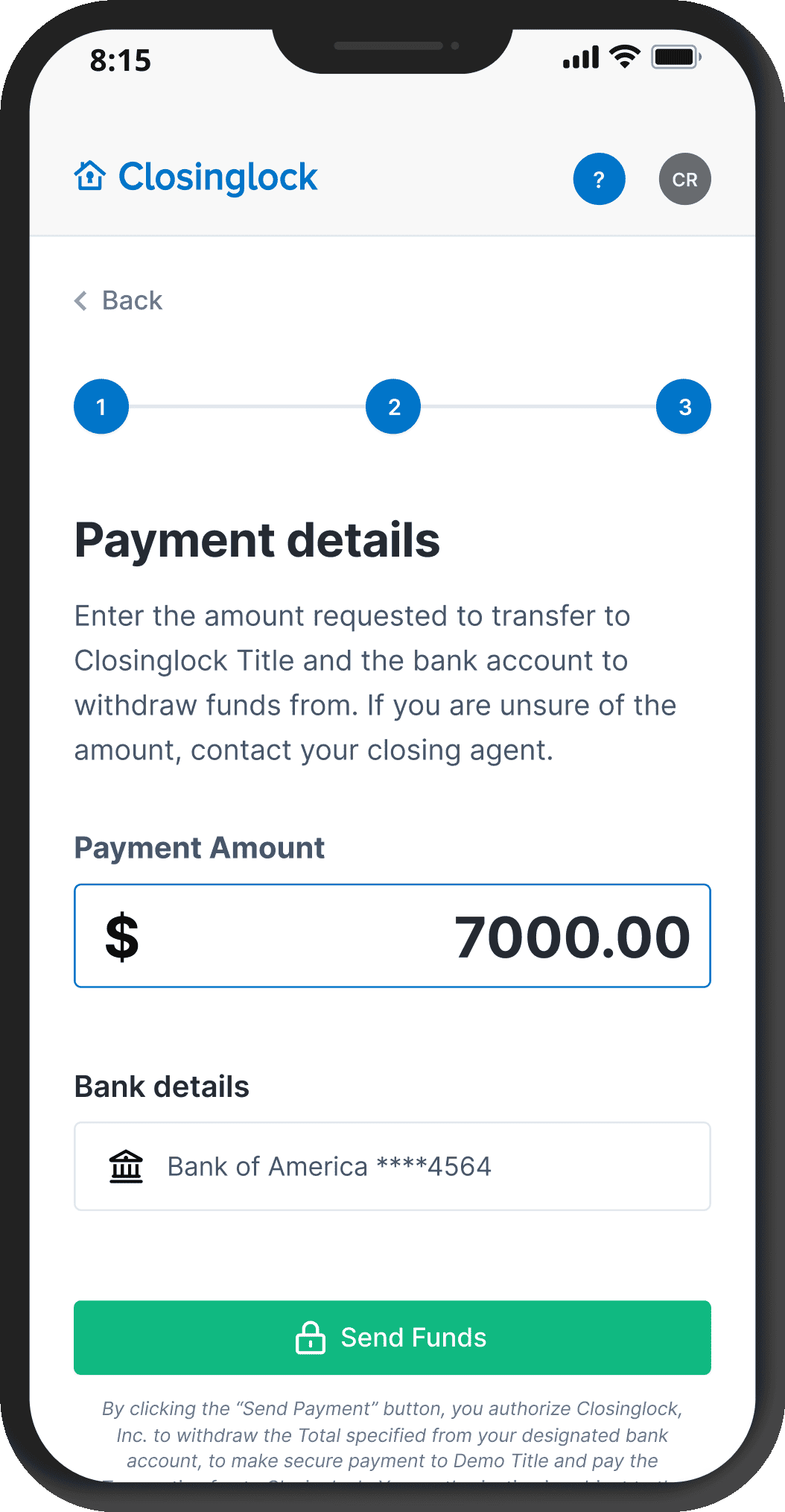

Transferring funds no longer has to be a nerve-racking or time-consuming process for your buyers. From a desktop or mobile device, they can securely send funds to your escrow account in just a few easy steps:

1.

The Good Funds tool is easily accessed from the home screen

2.

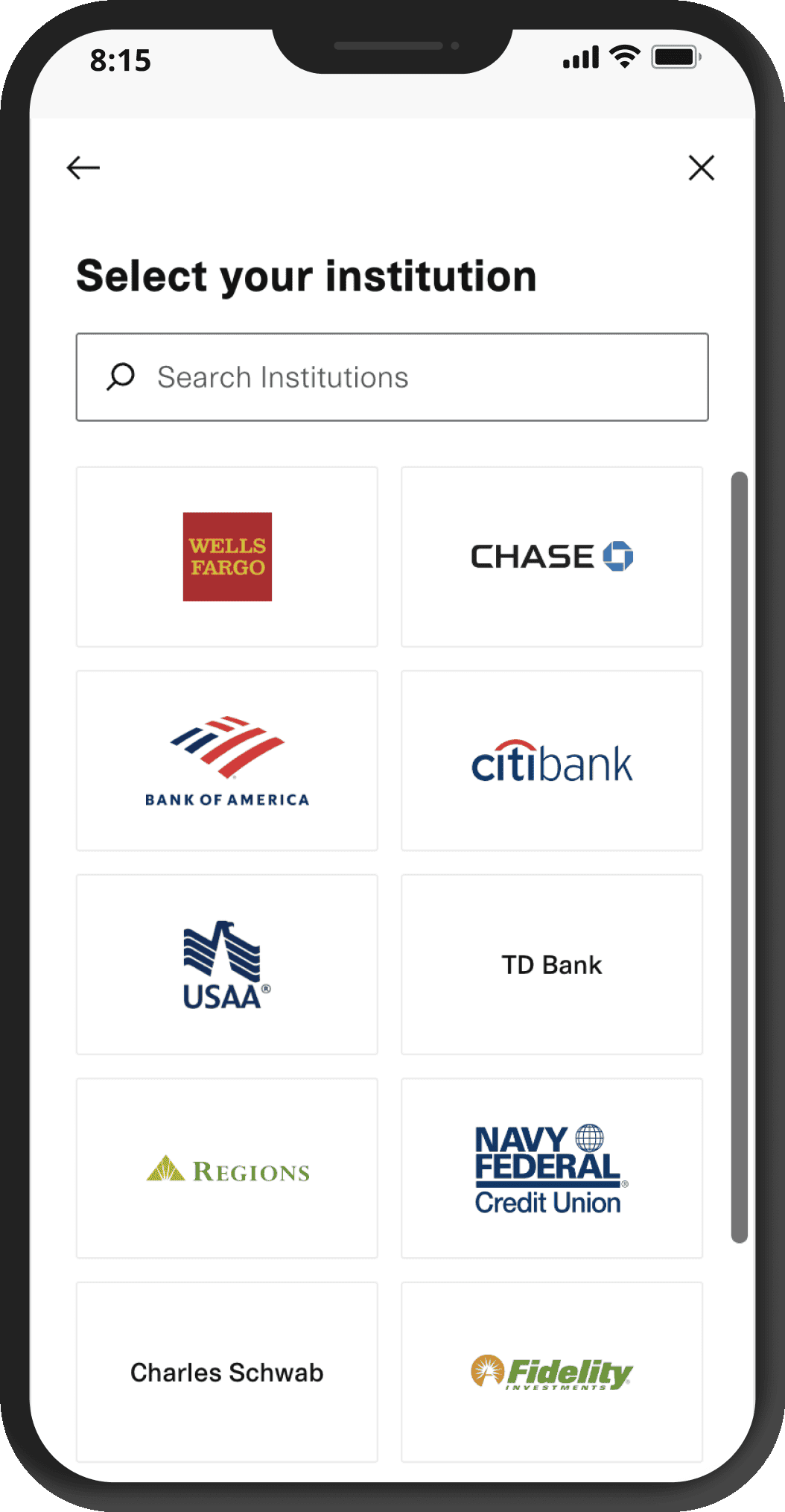

Buyers will log into the bank account they’re sending from

3.

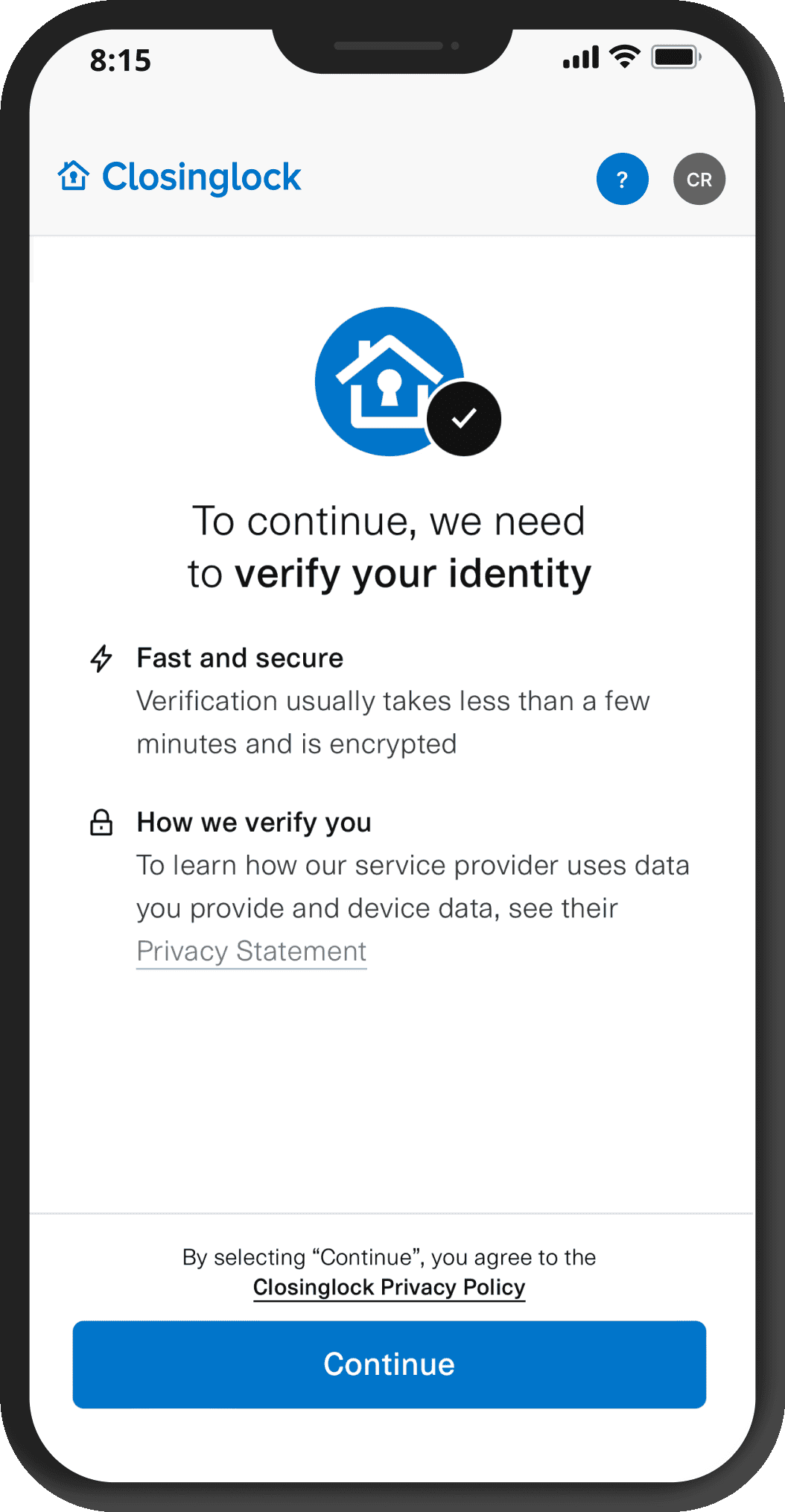

A quick and easy identity check will verify the sender

4.

After entering and confirming the amount, the funds are sent!

Adding speed and versatility with Real Time Payments (RTP)

Closinglock’s Good Funds tool can also be used to receive Real Time Payments in place of wire transfers. These payments are instantaneous, low cost and can be made year-round and after business hours.

If you’re interested in learning more about Real Time Payments, or want to see if your bank is an active participant, check out the following resources:

Modern Treasury: What is RTP?

The Clearing House

Federal Reserve Bank Services

"With Closinglock, I feel great knowing that our clients’ most critical information is secure. Closinglock has also helped us step into the modern age with their payment feature, as clients no longer have to write a check or send a wire for their closing payments.”

Peyton Coker

KEY TITLE GROUP

Director of Operations

Frequently Asked Questions

Why should our buyers use the Closinglock portal to make a payment instead of working directly with their bank?

Sounds great for the buyers, but what’s in it for us at the Title Company?

You won’t be subject to bounced checks due to insufficient funds or out-of-date checks. This qualifies as a “Good Funds” payment in all 50 states. We provide all proper documentation required by any lenders or title insurance providers. The Closinglock payment portal eliminates human error that your clients could provide and offers a clear linkage to a file number and buyer for all payments.

Our company receives a lot of calls from buyers who want to know if we have received their payment. How does sending the payment through Closinglock help?

We notify the buyer via text and email when the payment has successfully deposited into your escrow account, giving them peace of mind and the documentation necessary to show proof of payment.

How much time is this going to take my staff to learn and do we have to completely change our process for collecting payments?

If you are already a Closinglock customer sending wire instructions to your buyers, there is no additional training or process changes required. In fact, allowing buyers to send payments through the Closinglock portal saves your company valuable time by eliminating the need to validate, scan and deposit checks.

Is there any setup required with my escrow account to enable payments to be deposited into this account?

We are not sending the payment to the escrow bank account as an ACH Credit like other payment products, and therefore no additional setup or permissions are required to receive payments from the buyer.

Closinglock has protected over $350B for clients in all 50 states.

Join the thousands of title agents and attorneys who use Closinglock to eliminate fraud and streamline operations.