Securely exchange wire instructions

According to the FBI, business email compromise (BEC), a common tactic used by cyber criminals to commit real estate wire fraud, accounted for $2.9 billion in losses in 2023 alone.

With Closinglock, title companies and law firms can put wire fraud in the rear view mirror, securely sending and receiving wire instructions through an encrypted, SOC 2, Type II-certified portal.

Protected

Wire instructions are safely secured in our proven, 256-bit AES encrypted portal.

Transparent

Exchange wire instructions and trace every step of the process in real time.

Verified

Banking information is automatically verified through our integration with Plaid.

Designed to secure and simplify your closing process

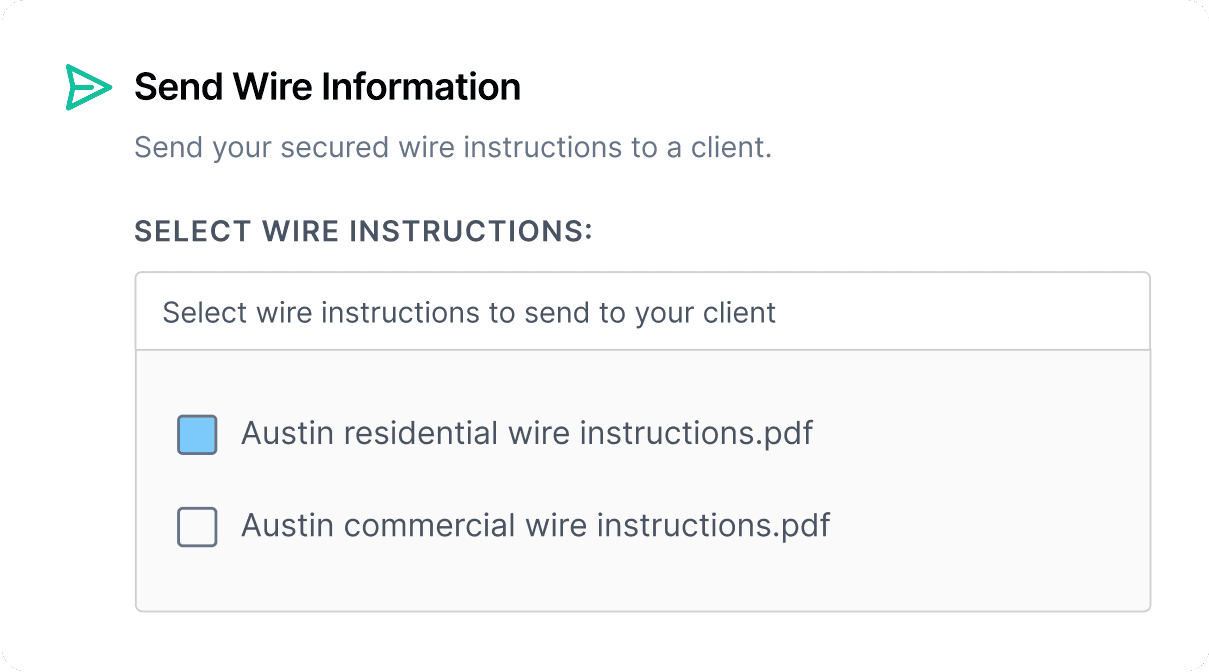

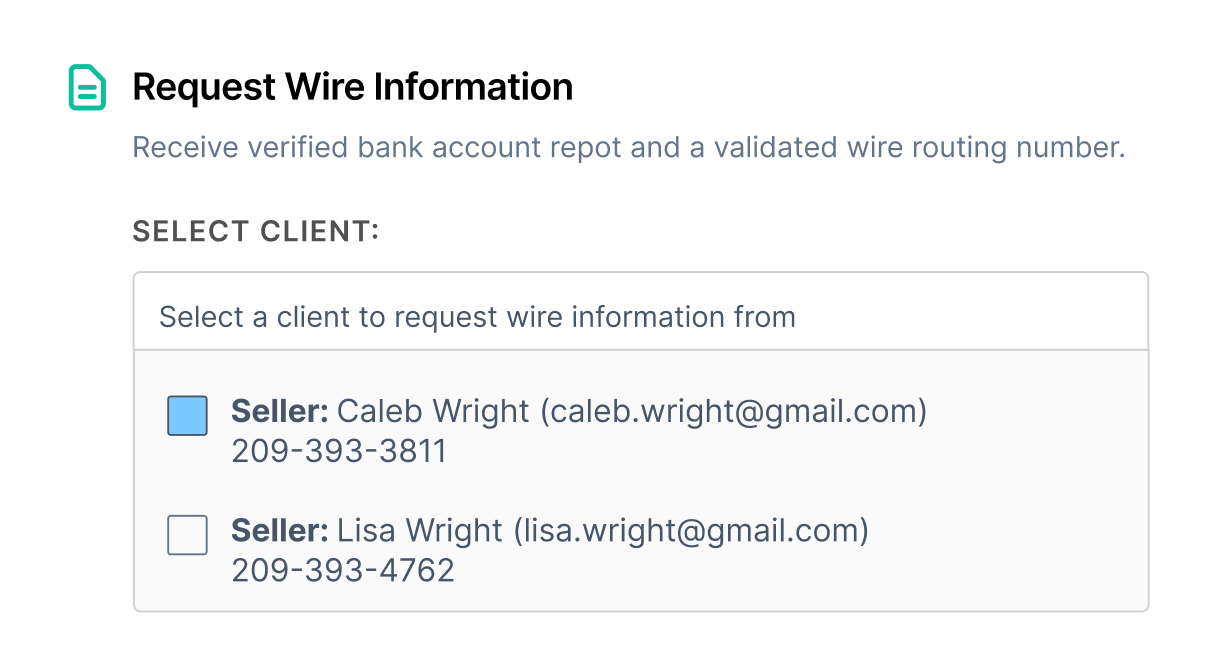

Sending and receiving wire instructions through Closinglock is a breeze. Once a file is opened, you can immediately send existing instructions to your buyer, or request instructions from your seller.

When sending wire info:

- Eliminate the risk of business email compromise (BEC)

- Protect every customer’s sensitive personal and financial data

- Receive a Wire Download Certificate for peace of mind

When receiving wire info:

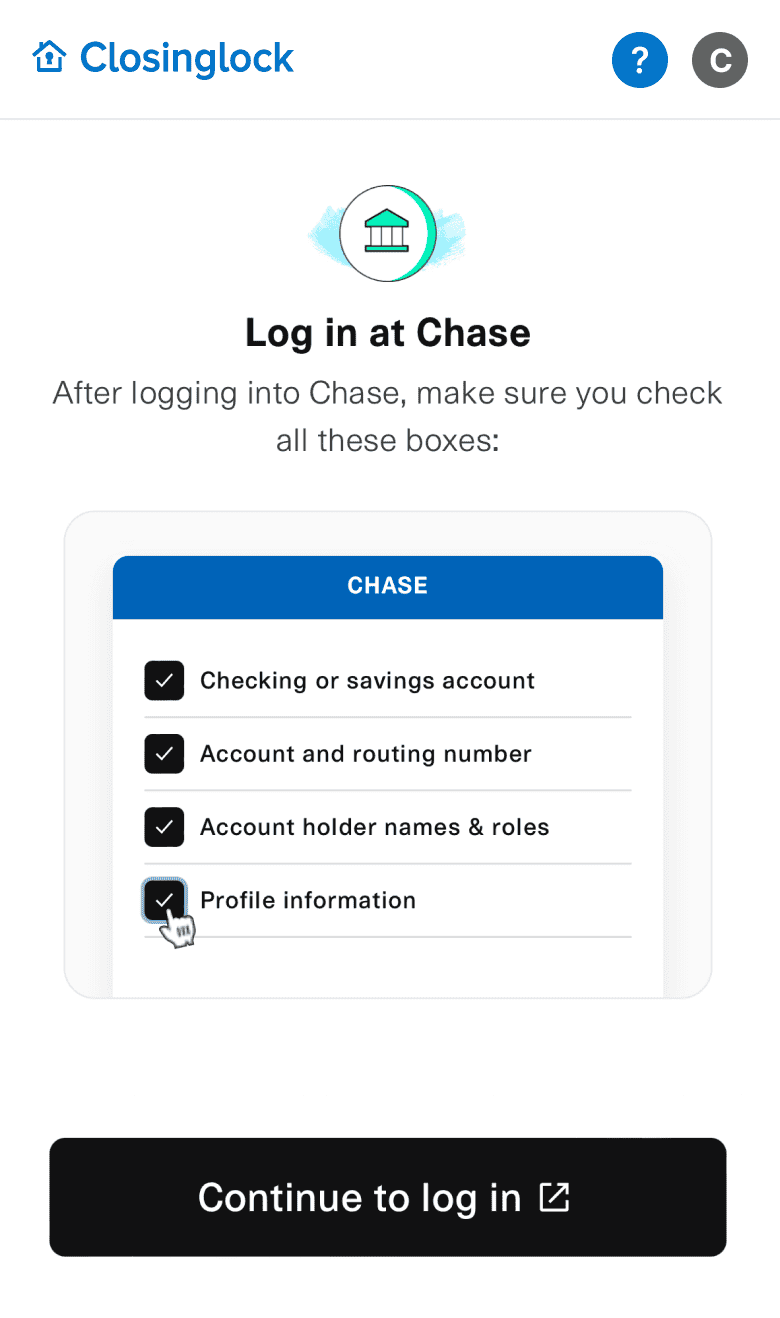

- Sellers can upload and verify banking information through Plaid

- Our Plaid integration connects to over 13,000 financial institutions

- Bank credentials are never stored or sent to Closinglock servers

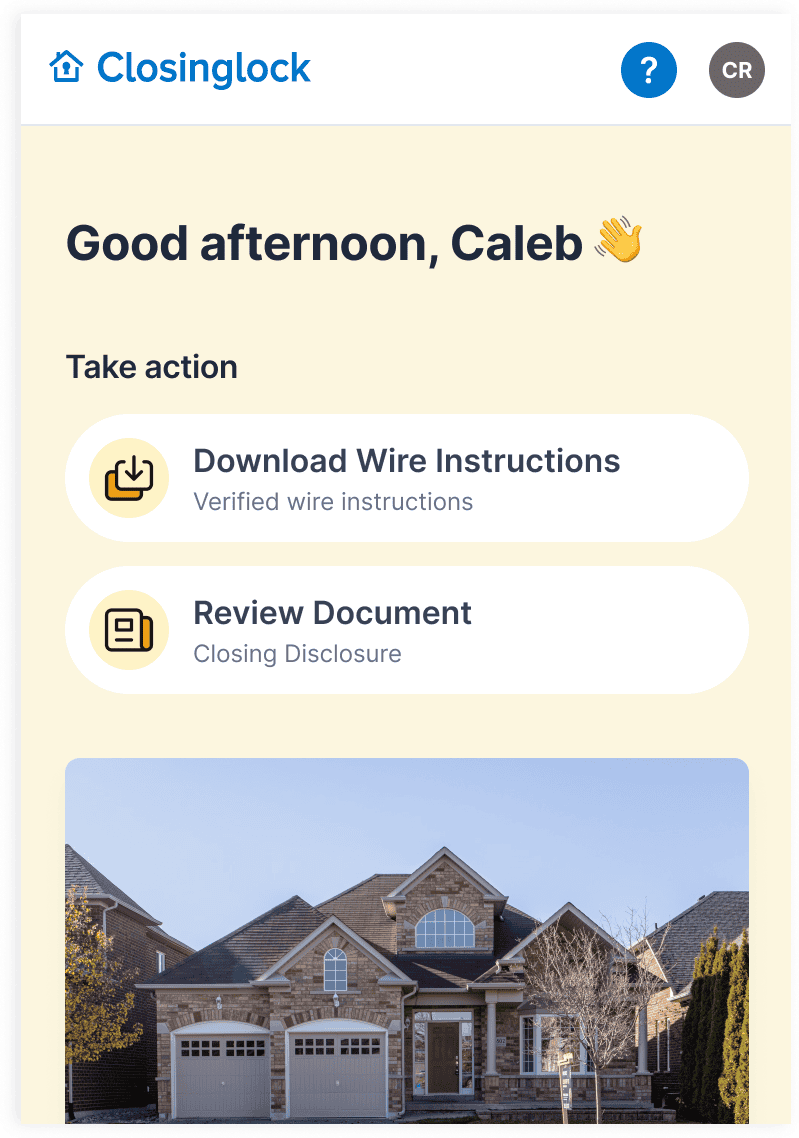

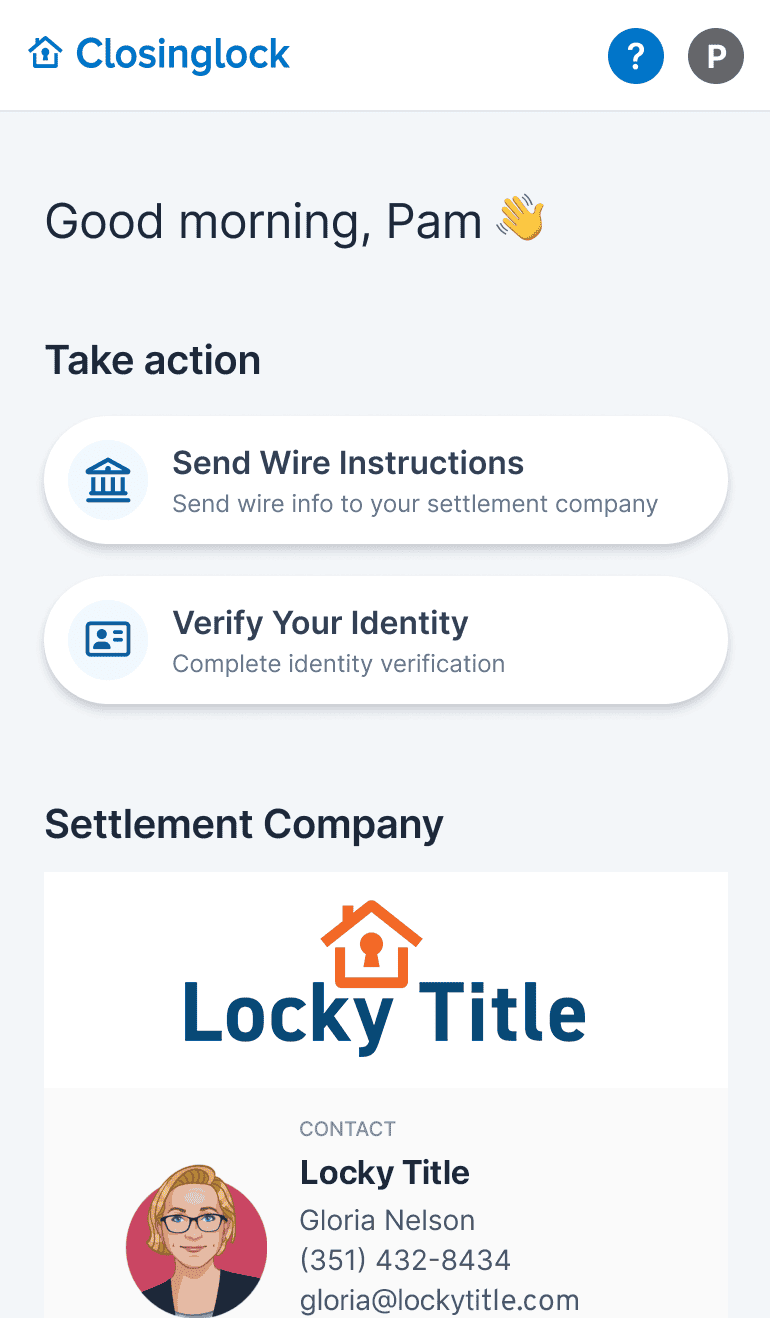

An effortless experience for buyers and sellers

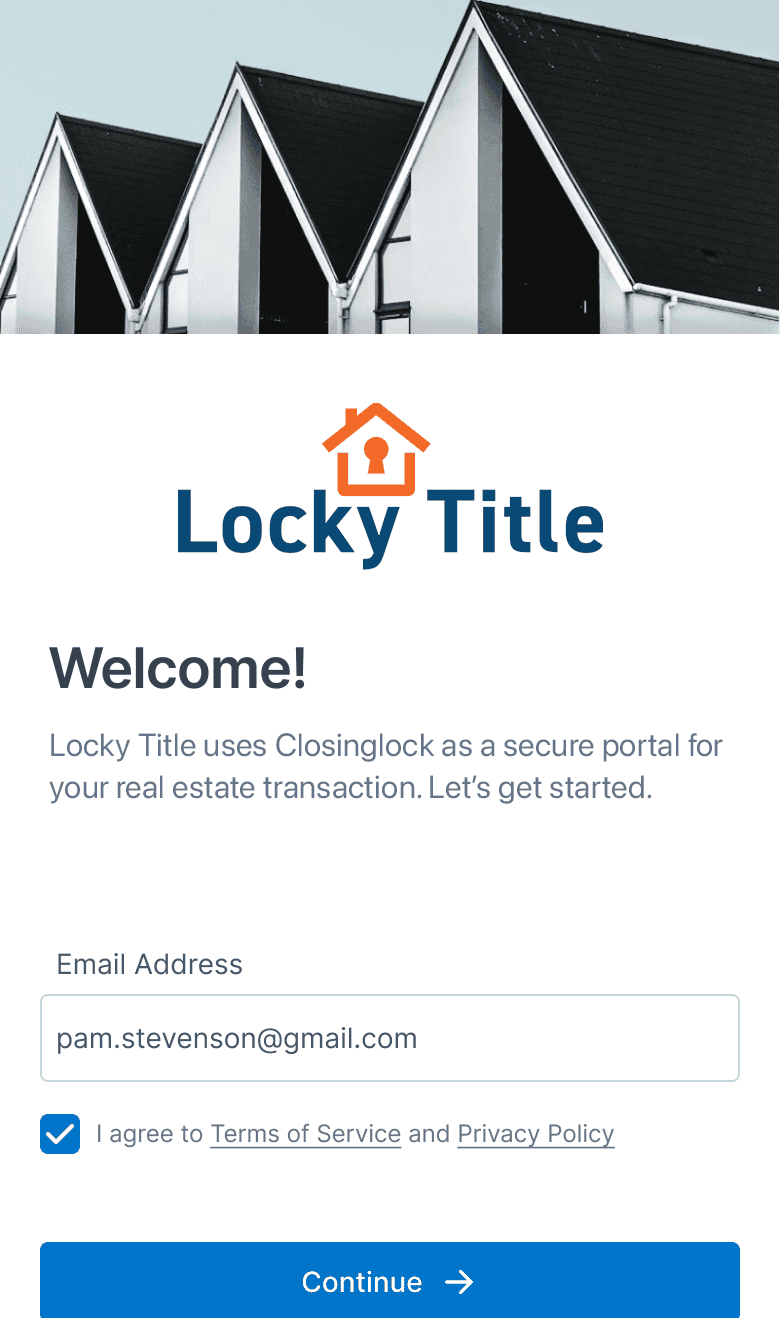

Through Closinglock’s secure portal, your clients will have peace of mind knowing their funds will arrive at their intended destination. And better yet, the quick and convenient process takes just moments to complete.

1.

Using multi-factor authentication, your client will enter their email and unique code they receive to log in.

2.

Once logged in, your seller (in this instance) can choose to send wire instructions manually or through Plaid.

3.

Through Plaid, your seller logs into their bank account to automatically format and send their wire instructions.

“Closinglock has improved the efficiency of our workflow and provides our clients with peace of mind when it comes to wiring.”

E. Adelaide Crawford

CRAWFORD LAW GROUP

Attorney

Frequently Asked Questions

Why do fraudsters target the real estate industry?

Fraudsters target those who are vulnerable. The real estate industry has billions of dollars every year being transferred between buyers and sellers. With so much involved in a real estate transaction, it is easy to sneak in, gather info and create a scam.

Will Closinglock’s wire transfer fraud protection work with my current software?

Yes, Closinglock’s wire transfer fraud protection is designed to seamlessly integrate with closing and title company software: Softpro, Ramquest and Resware.

Will my customers be required to download an app to use the portal?

What is Plaid?

Why should I use Closinglock for wire transfer fraud protection?

Not only does Closinglock offer a secure portal for exchanging wire instructions, but also sends out automatic email/text notifications, has multi-factor authentication and custom branding. In addition, the Closinglock system uses wire fraud warnings and pop-ups to conveniently and consistently educate your customers throughout the entire process.

Does this add any extra work/time for my customers?

The Closinglock system is simple, intuitive and easy for your customers to use. With simplicity and ease-of-use in mind, Closinglock developed a system that allows your customers to gain secure access to wire instructions without having to register, create a password or download an app. Closinglock’s portal was specifically designed so your customers can securely send their wire instructions and personal documents back to you, along with legally binding electronic signatures.

Closinglock has protected over $350B for clients in all 50 states.

Join the thousands of title agents and attorneys who use Closinglock to eliminate fraud and streamline operations.