The Secure Way for Closing Teams to Get Paid

When your reputation and closings are on the line, don’t settle for less. Closinglock SecurePay gives you the power, protection, and peace-of-mind you won’t find with the rest.

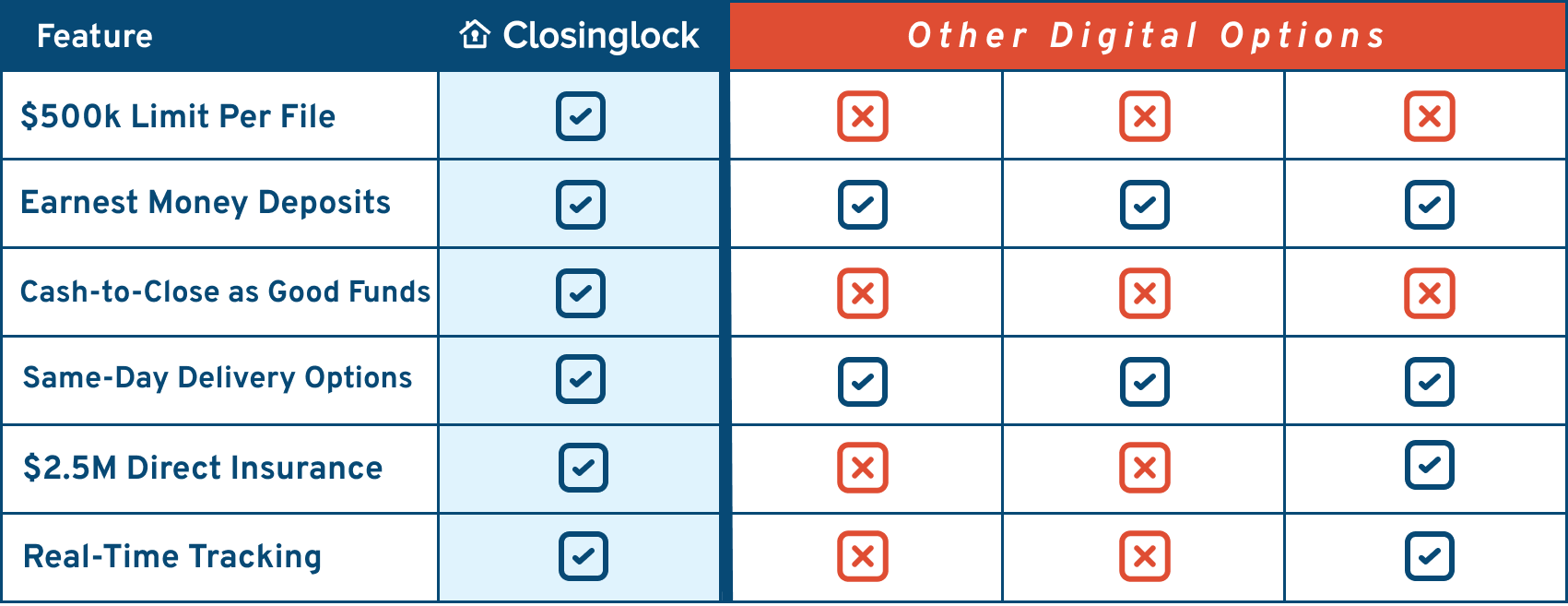

SecurePay vs. Other Payment Tools

Trusted by title and settlement professionals to securely move over $2B in closing funds, SecurePay delivers unmatched speed, security, and peace-of- mind — offering up to $500K per transaction, Good Funds compliance, and same-day delivery options.

Get In Touch

1. What types of payments can I collect with Closinglock SecurePay?

You can securely collect Earnest Money Deposits (EMD) and Cash-to-Close (CTC) payments as Good Funds. This solution is designed to handle all closing funds safely, eliminating the need for multiple tools or risky wires.

2. How is Closinglock Payments different from ACH-based tools?

Unlike ACH payments, which can take days and are reversible, Closinglock uses Good Funds-compliant wire transfers that are delivered as soon as the same day. This means no clawbacks, no delays, and full compliance for EMD and CTC payments.

3. Who uses Closinglock SecurePay?

Title agents, law firms, and lenders in all 50 states trust Closinglock to protect their payments and provide a better experience for their clients.

4. How does payment reconciliation work?

Closinglock Payments automatically matches every payment to its corresponding file. Automated receipts and confirmations save your team hours of manual reconciliation.