We’re at an inflection point. The way money moves in real estate hasn’t changed since the early 1980s—we’re still relying on wires, checks, email, phone calls, even fax machines to move $2 trillion in and out of escrow every year. And the system handling it is now more than 40 years old.

Money should flow simply: in from the buyer, out to everyone who needs to be paid. Instead, it’s slow, manual, and vulnerable to mistakes and fraud.

Inbound payments still rely on wire or paper checks. Buyers leave work to visit a bank, staff manually confirm receipts, and closings stall waiting for funds to post.

Outbound disbursements are even riskier. Title companies pay off mortgages, wire proceeds, cut checks, and send money to HOAs, insurers, and more—under tight deadlines and with no room for error.

Most teams patch the process together with separate point solutions that don’t connect, forcing staff to re-key data and chase updates. Every extra step adds risk—another chance for delays, errors, or lost funds

The industry deserves a better way.

Our vision: one secure system for the entire flow of funds

At Closinglock, we’re protecting the flow of funds and modernizing how money moves in real estate.

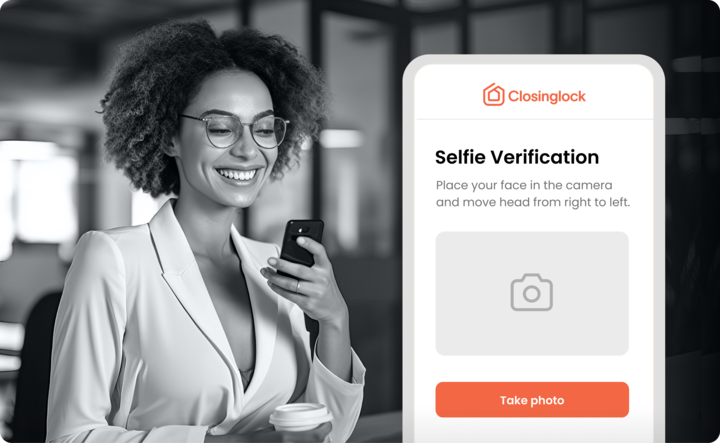

We set a new standard for how inbound payments are made in real estate with SecurePay, the industry’s first Good Funds–compliant solution that lets buyers send funds from any device in minutes. Buyers have already sent more than $2 billion in earnest money and cash-to-close payments through the platform—with zero losses and a 4.7-star rating.

Now we’re applying that same trusted approach to outbound payments so every dollar that leaves escrow is just as fast, secure, and insured.

Disbursements are the riskiest and most time-consuming part of a closing. It only takes one mistyped digit or spoofed email to send hundreds of thousands of dollars to the wrong place. And at this stage, title companies and underwriters are directly liable if something goes wrong.

Our research shows that title professionals spend 9–18 hours per transaction on disbursements. This number often surprises people because it isn’t one big block of time—it adds up step by step. Teams track down lender payoffs, wait on callbacks, re-key borrower and payoff data into multiple systems, reconcile records, and finally push funds out to every party. All of that is time that could be spent serving clients, growing the business, or simply getting home on time.

The next step? We’re solving for one of the biggest pain points in the process: lender payoffs.

Introducing automated, insured payoff requests

Our research shows that payoff retrieval often takes title teams 25–75 minutes per file to log into portals, submit forms, send faxes, follow up with no confirmation, and track everything manually. For a team handling 100 payoffs a month, that can add up to 125 hours spent just chasing statements.

With Closinglock, title and settlement teams can order payoff statements in seconds. Once retrieved, they are automatically routed through Closinglock’s verification tool, and every verified payoff is insured for $5 million.

Automated payoff retrieval replaces a fragmented, high-risk workflow with one that’s connected and protected. By bringing everything into one secure system, we can thoughtfully use AI to handle the repetitive, computer-heavy work that slows closings down.

Why this matters

This isn’t about adding more software to an already complicated process. It’s about freeing title professionals from the time-consuming, tedious work so they can focus on the human aspects of the work—serving customers, building relationships within the industry, and growing their businesses.

It’s about protecting underwriters from unnecessary liability and giving them confidence that every dollar will get where it’s supposed to go.

It’s about giving buyers and sellers peace of mind that their money will arrive safely, on time, and without the stress of callbacks, manual tracking, or wire fraud risk.

Ultimately, it’s about replacing a 40-year-old system with one that’s built for the way money moves today—faster, easier, safer, and smarter.

What’s next?

Payoffs are just one step. Title companies also spend hours every month managing uncashed checks and unclaimed funds—sometimes for just a few cents. Each check has to be reviewed, recorded, and reported, pulling teams away from higher-value work and adding no benefit to the client experience.

Because Closinglock already retrieves and verifies payoff statements, collecting the inbound funds and data, the natural next step is to autopopulate that information and automate the disbursement of funds back to those verified accounts.

Keeping all this data inside one secure system means no retyping, no double-checking, and no callbacks—just verified, insured payments sent in minutes. Soon, title companies will also be able to send buyer EMD refunds, lender payoffs, and seller proceeds through Closinglock, with the flexibility to pay any party securely from the same platform.

The future of real estate finance will be built on trust. We’ve already moved billions safely through SecurePay with zero losses, backed by industry-leading insurance. And with the only platform built to protect the entire flow of funds, we’re not just modernizing money movement—we’re building the trusted payments infrastructure for real estate.

Learn more about how Closinglock’s payoff retrieval solution can save your team hours and protect every dollar here.